TL;DR

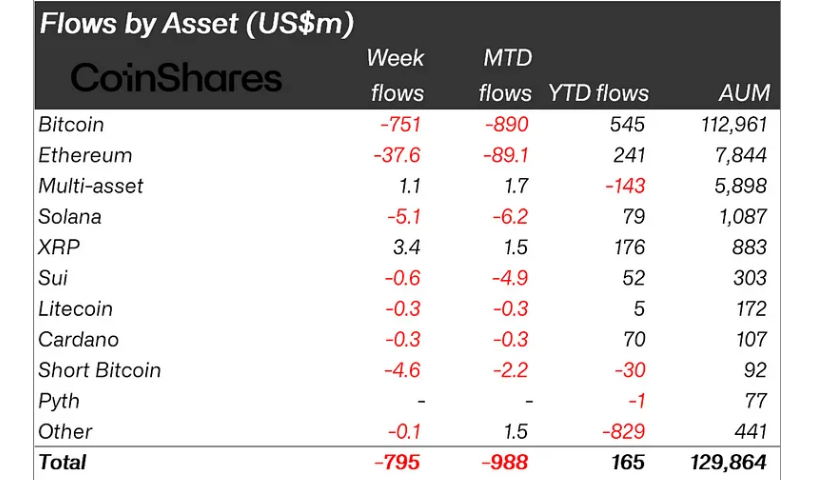

- Crypto investment products experienced outflows totaling $795 million last week, adding up to over $7.2 billion since February.

- Bitcoin led with $751 million in withdrawals but still holds $545 million in net year-to-date inflows.

- XRP, Ondo, Algorand, and Avalanche saw positive inflows, showing selective investor confidence in resilient altcoins.

Crypto-based investment products have faced heavy pressure in recent weeks, marking their third straight week of outflows, this time reaching $795 million. Since early February, total outflows have surged past $7.2 billion, nearly erasing all the gains made earlier in the year, leaving year-to-date inflows at just $165 million. However, many pro-crypto voices argue this drop reflects a healthy market correction rather than a sign of long-term decline. For them, the current market phase offers a golden opportunity to accumulate strong assets before the next bullish rally truly begins.

Bitcoin Leads the Withdrawals, Yet Maintains Strength

Once again, Bitcoin took the hardest hit, recording $751 million in outflows last week alone. Even so, it continues to show net inflows of $545 million for the year, indicating that investor confidence in its long-term fundamentals remains strong. Ethereum followed with $37.6 million in outflows. Other projects such as Solana, Aave, and Sui were also affected, although to a lesser extent.

Market analysts have linked this negative wave to broader macroeconomic pressures, including the uncertainty caused by U.S. tariff threats. That said, the partial rollback of those tariffs by President Trump toward the end of the week helped push asset prices back up. This rebound boosted the total assets under management to $130 billion, an 8% recovery from their lowest point on April 8. Even short-Bitcoin products, which profit from price drops, experienced outflows of $4.6 million, signaling a possible sentiment shift.

Resilient Altcoins Attract Strategic Inflows

While major assets struggled, several altcoins bucked the trend. XRP led the way with $3.4 million in inflows, followed by Ondo with $0.46M, Algorand with $0.25M, and Avalanche also with $0.25M. Although relatively small figures, these inflows suggest that certain investors are reallocating funds into projects they view as undervalued or more future-proof.

Rather than interpreting these developments as the start of a crypto winter, many in the space believe the market is entering a phase of consolidation. This is a moment where savvy investors reassess and strengthen their positions while the global financial environment grows more intricate and challenging.