TL;DR

- Crypto funds are facing a record exodus of $3.8 billion in the last three weeks, creating uncertainty in the market and leaving many investors concerned.

- Bitcoin bore the brunt of the losses, with $2.59 billion in outflows, while Ethereum also saw negative flows, and other altcoins followed a similar downward trend.

- Despite the negative trend, German investors seized the opportunity presented by the price drop, with $55.3 million invested, highlighting regional differences in investor behavior.

In the past three weeks, crypto investment products have seen a massive outflow of capital, totaling $3.8 billion. The last week marked the largest single outflow on record, with $2.9 billion withdrawn from digital asset funds. This exodus has been driven by several factors, such as the recent Bybit hack, a more aggressive stance by the U.S. Federal Reserve, and the prior 19-week streak of positive inflows totaling $29 billion. This combination of factors has led to a mix of profit-taking, risk aversion, economic uncertainty, and a general weakening of sentiment towards cryptocurrencies, exacerbating the downturn.

Bitcoin bears the brunt of the downturn

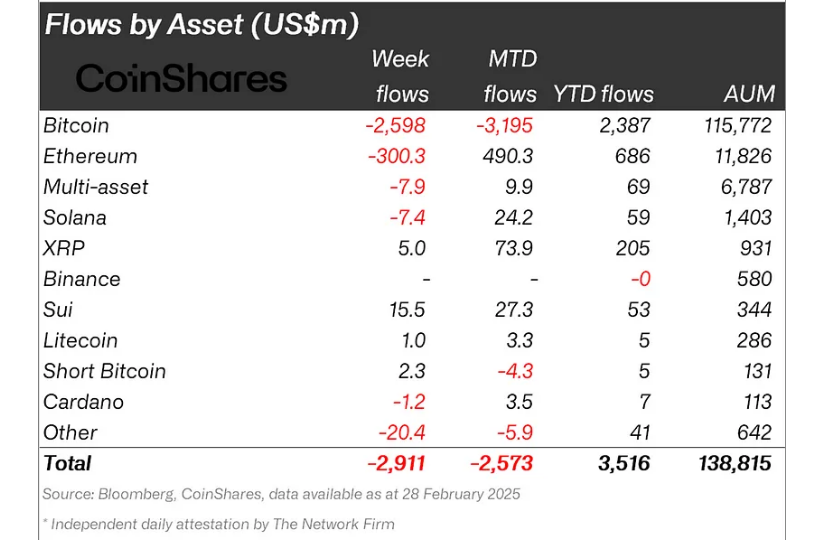

The asset most affected by this decline in confidence has been Bitcoin, which experienced a significant loss of $2.59 billion just in the past week alone. Additionally, although the broad market downturn has resulted in outflows from other cryptocurrencies like Ethereum, which saw $300 million in outflows, the market has shown that investors are seeking refuge in less volatile assets. This shift was reflected in the minor $2.3 million investment in short Bitcoin positions.

However, amidst these declines, some cryptocurrencies have shown resilience. Sui stood out as the best-performing crypto during this period, registering $15.5 million in positive inflows, followed by XRP with $5 million.

Opportunities for some investors

While most regions experienced outflows, German investors saw the price drop as an opportunity to increase their positions, adding $55.3 million during this period. In contrast, U.S. investors were the hardest hit, with $2.87 billion in outflows, followed by Switzerland and Canada with $73 million and $16.9 million, respectively. This reveals geographic divergences in market attitudes, where investors in some regions viewed this downturn as a buying opportunity, while others took a more cautious approach.

Despite the massive outflows, the outlook isn’t entirely grim. James Butterfill, Head of Research at CoinShares, pointed out that the announcement of a potential strategic crypto reserve by President Donald Trump could boost market confidence, especially among traditional asset managers, leading to a potential reversal of these outflows and renewed optimism.