TL;DR

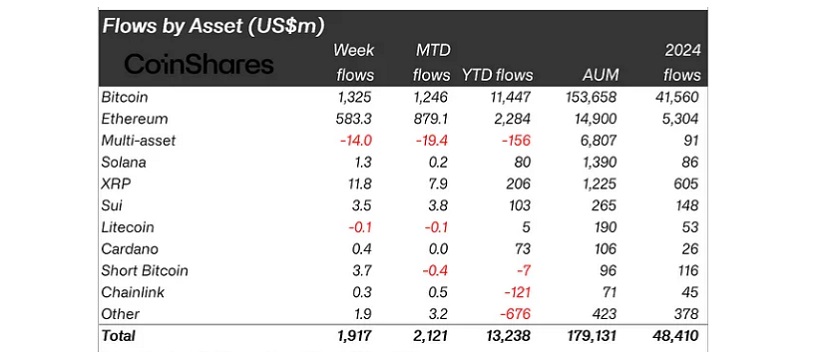

- Digital asset investment products saw inflows of $1.9 billion last week, marking nine consecutive weeks of positive flows.

- Bitcoin led with $1.3 billion, while Ethereum contributed $583 million, its strongest inflow since February.

- The United States drove most of the inflows, while altcoins like XRP and Sui also attracted renewed institutional interest.

After a cautious start to the year, crypto funds are once again attracting significant institutional capital. According to the latest detailed report from CoinShares, cryptocurrency investment products saw inflows of $1.9 billion last week alone, bringing the total accumulated for the year to a record $13.2 billion. This bullish trend has held strong for nine consecutive weeks, with institutional appetite showing clear signs of strengthening, even amid global geopolitical tensions that have significantly affected other markets.

Bitcoin and Ethereum Lead the Resurgence of Investor Interest

Bitcoin captured the majority of weekly inflows with $1.3 billion, marking a clear rebound after two weeks of slight outflows. Meanwhile, Ethereum gathered $583 million, hitting its highest weekly inflow since February, including one particularly strong day. ETH inflows during this period now represent 14% of the assets under management (AuM) within the Ethereum investment ecosystem. This growth also reflects renewed confidence in these assets as both safe havens and important performance drivers in an increasingly dynamic market environment.

It wasn’t only the top cryptocurrencies benefiting. XRP, after three weeks of outflows, recorded $11.8 million in inflows, and Sui attracted $3.5 million. Even Solana added $1.3 million, signaling a clear diversification strategy among investors seeking exposure to projects with solid fundamentals and medium-term growth potential and promising outlooks.

United States Leads as ETF Consolidators Drive the Movement

All of the positive weekly inflows came from the U.S. market, while countries such as Germany, Canada, and Switzerland contributed more modest amounts. In contrast, Brazil and Hong Kong displayed a more cautious stance with capital outflows.

BlackRock, through its iShares IBIT ETF, was responsible for nearly 70% of total inflows. Launched in partnership with Coinbase, this vehicle has amassed over $70 billion in assets under management in record time. Grayscale, Fidelity, ARK, and Bitwise also showed activity, albeit to a lesser extent.

The persistence of inflows even during weeks marked by global tensions suggests that investors are increasingly convinced of the strategic role of digital assets. Beyond retail enthusiasm, this phase appears to be driven by a structural shift from traditional finance.