TL;DR

- Bitcoin drops 25% monthly to $69,000 as crypto ETFs face $5.8 billion in outflows.

- BlackRock’s IBIT loses $2.8 billion in the quarter, contrasting with $21 billion prior inflows.

- Matt Hougan notes financial advisors hold positions; selling comes from hedge funds.

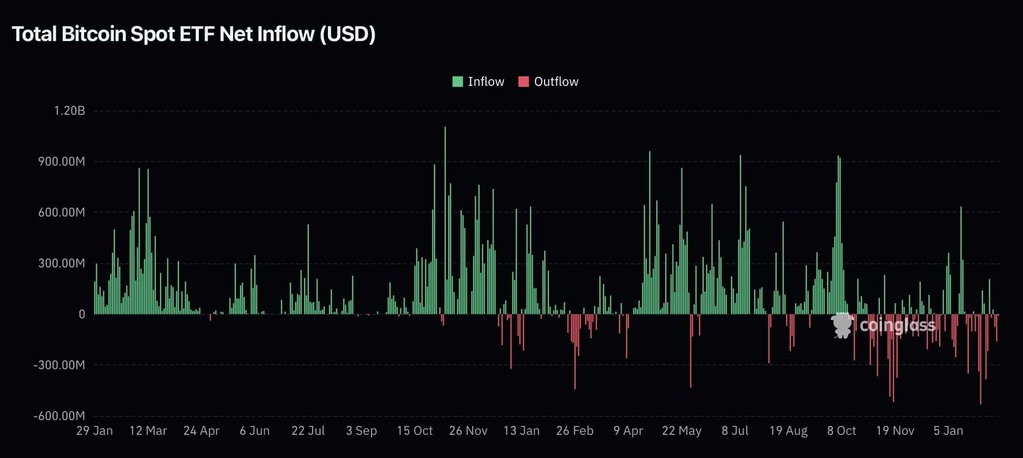

Bitcoin records a decline exceeding 25% over the last month, while cryptocurrency exchange-traded funds (ETFs) experience massive institutional capital outflows. The current price hovers around $69,000, well below the all-time high of $126,000 reached last October.

BlackRock’s iShares Bitcoin Trust (IBIT) accumulated net outflows of approximately $2.8 billion during the last quarter. However, the figure contrasts with nearly $21 billion in net inflows recorded during the previous year. Spot ETFs as a whole reflect the same trend, with exits near $5.8 billion over three months.

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, notes the selling pressure comes primarily from short-term traders and hedge funds. The executive states financial advisors maintain their positions despite market volatility.

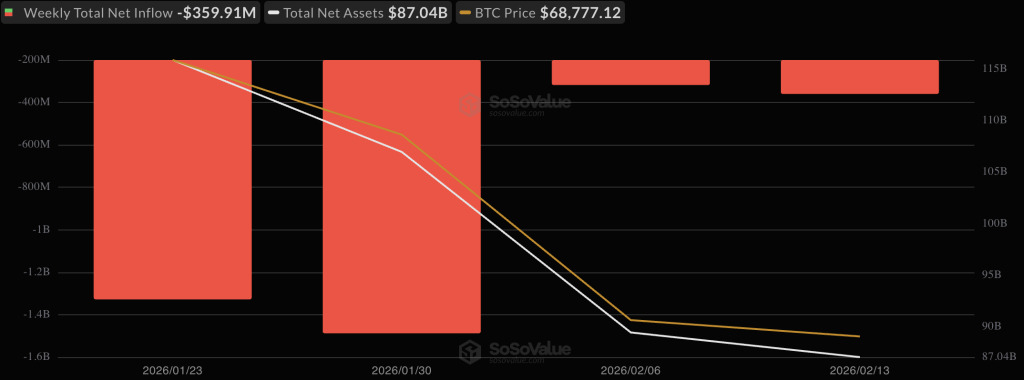

Amberdata data reveals accumulated flows in 2026 entered negative territory for the first time since product launch. In early February, crypto products registered a net outflow of $1.7 billion, signaling a pause in the constant accumulation regime.

Week of February 9-13 Marks Asset Divergence

The second full week of February presented divided performance among different cryptocurrency ETFs. Spot Bitcoin ETFs closed with net outflows of $359.91 million, while Ethereum lost $161.15 million.

BlackRock IBIT endured sustained pressure throughout the week. The fund registered $20.85 million in outflows on Monday, February 9, followed by $73.41 million on Wednesday, $157.56 million on Thursday, and another $9.36 million on Friday. A $26.53 million inflow on Tuesday barely offset losses, leaving a negative balance of approximately $234 million weekly.

Fidelity FBTC swung sharply, starting with $3.08 million inflow before losing $92.60 million and $104.13 million midweek. Friday recovered $11.99 million, but ended with $124 million net loss. Grayscale GBTC closed with $77 million negative, while Ark and 21Shares’ ARKB lost nearly $19 million.

Feb 16 Update:#Bitcoin ETFs:

1D NetFlow: -1,444 $BTC(-$98.86M)🔴

7D NetFlow: -5,555 $BTC(-$380.44M)🔴#Ethereum ETFs:

1D NetFlow: -22,492 $ETH(-$44.42M)🔴

7D NetFlow: -91,151 $ETH(-$180.02M)🔴#Solana ETFs:

1D NetFlow: +27,729 $SOL(+$2.34M)🟢

7D NetFlow: +148,057… pic.twitter.com/K6h747Gg6L— Lookonchain (@lookonchain) February 16, 2026

On February 16, data showed outflows of 1,444 BTC equivalent to $98.86 million and 22,492 ETH valued at $44.42 million in a single day. In contrast, Solana registered inflows of 27,729 SOL or $2.34 million daily and 148,057 SOL or $12.51 million over seven days.

The divergence reflects institutional rotation from established assets like Bitcoin and Ethereum toward altcoins. Solana attracts institutional capital thanks to its scalability and adoption in decentralized finance.

BlackRock’s ETHA led Ethereum losses with cumulative redemptions exceeding $112 million, while Fidelity’s FETH shed roughly $40 million across multiple sessions. Grayscale’s Ether Mini Trust saw inflows of $49.90 million, providing limited offset.

Total holdings stand at 1.26 million BTC, 5.71 million ETH, and 8.72 million SOL, highlighting Solana ETF maturity with Bitwise leading inflows.