TL;DR

- Crypto.com relaunches its app in the US and introduces an institutional exchange with access to over 300 cryptocurrencies and advanced tools like trading bots.

- The CRO token rose 7.9% following the announcement, though its value remains affected by the 2022 market crash.

- The platform offers USD and USDC withdrawals without conversion fees, instant transfers, and VIP services for institutional clients.

Crypto.com has announced the launch of its cryptocurrency exchange designed for institutional investors in the United States. This marks its return to the US market after suspending operations in 2022 due to regulatory challenges and the impact of events such as the collapse of the Terra/Luna ecosystems and FTX.

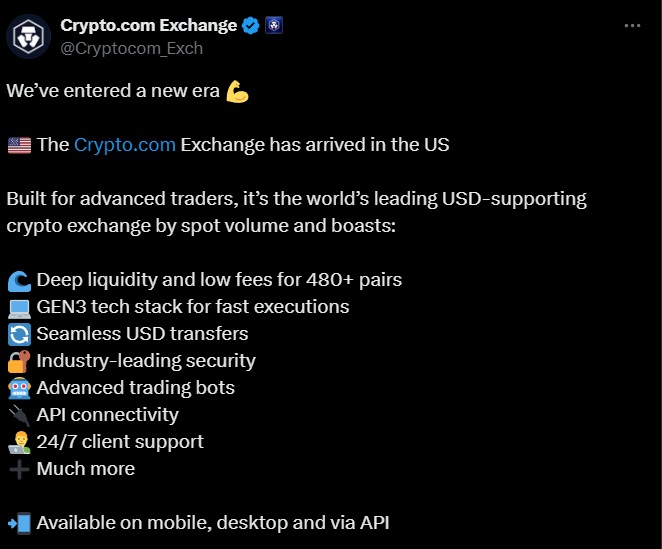

The new platform provides access to over 300 cryptocurrencies and 480 trading pairs with a customizable interface. It is optimized to deliver high speed and low latency in operations, catering to the needs of advanced traders. Additionally, it integrates features like advanced order types and automation tools, including trading bots such as DCA, GRID, and TWAP.

Crypto.com has also reintroduced its classic app for US users. This allows clients to manage their assets and participate in a global market supported by a solid regulatory framework and advanced technological capabilities. Additional features of the institutional platform include flexible withdrawal options in USD and USDC that eliminate conversion costs, as well as specialized services like instant transfers, customized OTC operations, and VIP programs offering exclusive benefits.

Crypto.com Prepares to Dominate the US Market

The platform’s native cryptocurrency, CRO, experienced a significant increase in value following the announcement, reaching $0.1445 after a 7.9% rise. However, its trajectory still reflects the effects of the 2022 market crash. Despite partial recoveries in recent years, Crypto.com’s return to the United States could open new opportunities for CRO in the global market.

Crypto.com’s CEO, Kris Marszalek, highlighted the effort invested in improving the exchange’s infrastructure to meet the demands of the institutional market. With more than 100 million customers worldwide, the company aims to establish itself as a leader in USD integration within spot markets, providing a reliable and robust alternative for cryptocurrency trading in the United States