TL;DR

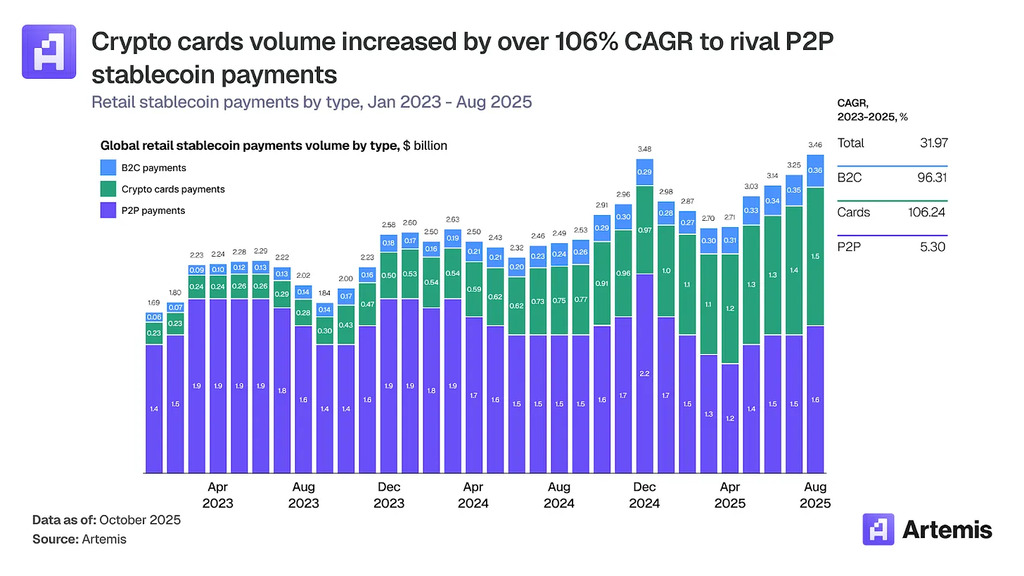

- Crypto card payments now match P2P stablecoin volumes at $1.5B monthly.

- Card payments grew 106% annually, far outpacing stablecoin P2P growth.

- Cards succeed by using existing payment networks, avoiding merchant integration hurdles.

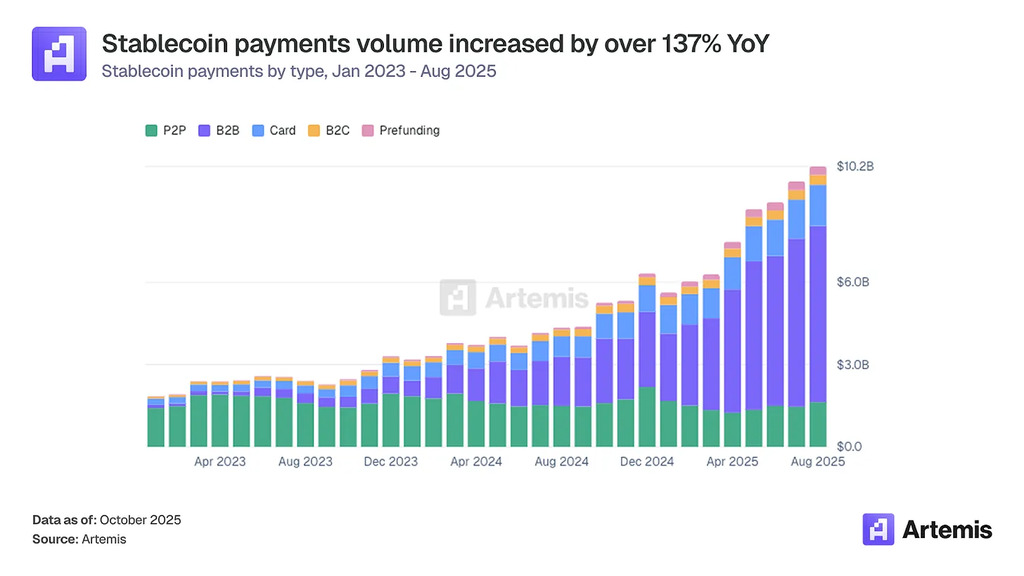

A recent report from the metrics platform Artemis details the growth of crypto cards. These products, which function as credit or debit cards linked to digital assets, have moved beyond a niche. The report indicates that payments with crypto cards now match the volume of peer-to-peer (P2P) stablecoin transactions.

The monthly amounts processed through this channel grew from $100 million in early 2023. By 2025, the monthly volume reached $1.5 billion. This figure approaches the $1.6 billion moved monthly by P2P payments with stablecoins.

Accelerated Growth Compared to Moderate Expansion

The Artemis analysis shows divergent growth rates. Crypto card payments recorded a compound annual growth rate of 106%. This pace raised the annual volume processed through this method to over $18 billion.

In contrast, the annual volume of P2P stablecoin payments reached $19 billion. However, this segment grew only 5% in the same period. The difference in adoption speed points to a clear market trend.

The report attributes this phenomenon to several practical factors. Native stablecoin payments face obstacles like a lack of widespread infrastructure and integration problems for merchants. Accounting considerations and new regulatory compliance demands also slow their direct implementation.

Crypto cards, on the other hand, use an already established payment system. They connect to the same traditional networks used by fiat cards. This design allows sending funds in traditional currency to merchants smoothly. The experience for the end user and the merchant does not require deep changes.

Artemis projects this trend will continue

Native P2P and B2B stablecoin payments will keep expanding. However, the complete replacement of card networks in the short term is unlikely. The report underscores the slow relative growth of direct stablecoin volume compared to cards.

The analysis conclusion highlights the bridging role of these products. Crypto cards will scale alongside stablecoin adoption. Their value lies in leveraging existing merchant networks. They function as the infrastructure connecting digital asset holdings with real-world commerce. The report identifies them as the foundation for the next phase of stablecoin adoption.