There is no stopping capital inflow in the cryptocurrency market. In the latest development, Coinbase Ventures and venture capital firm Sequoia China has led a $25 million funding round for DeBank, which happens to be a crypto-wallet focused on decentralized finance [DeFi] solutions.

The latest equity round for DeBank also saw the participation from crypto-asset investment firm Dragonfly, blockchain-focused fund management company Hash Global, venture capital firm Youbi, and other angel investors. In addition to the venture arm of cryptocurrency giant Coinbase, the strategic investors for the deal were Crypto.com, Circle, and Ledger.

According to the official announcement by DeBank, the company’s valuation following the capital inflow now stands at $200 million. The company has not disclosed the objective of the funding yet.

The Singapore-based cryptocurrency platform Crypto.com confirmed the development and tweeted,

“Crypto.com Capital is excited to support DeBank to bring the next billion users to Web3.”

For the uninitiated, DeBank is a crypto wallet that tracks data for decentralized finance, applications, or exchanges as well as interest rates. The platform lets users track and manage their DeFi investments. It enables tracking of almost 800 protocols across 17 chains such as Ethereum [ETH], the Binance Smart Chain [BSC], Polygon [MATIC], Fantom [FTM], Avalanche [AVAX among others.

Southeast Asian DeFi startups Raise $1B in 2021

2021 has many watershed moments for the crypto ecosystem. After a protracted crypto winter, the industry witnessed not just a dynamic upward price movement but also institutions and big-league players entering the space at a pace never seen before.

Beyond the initial skepticism, market players, both big and small, are now exploring the possibilities of blockchain technology and crypto. The COVID pandemic had the crypto industry thrown into the limelight with new headline-grabbing developments about projects surfacing to solve real-world use cases via NFTs, DeFi, Web 3.0, etc. As tech startups focused on the convergence of these sectors proliferated, so did the investor appetite.

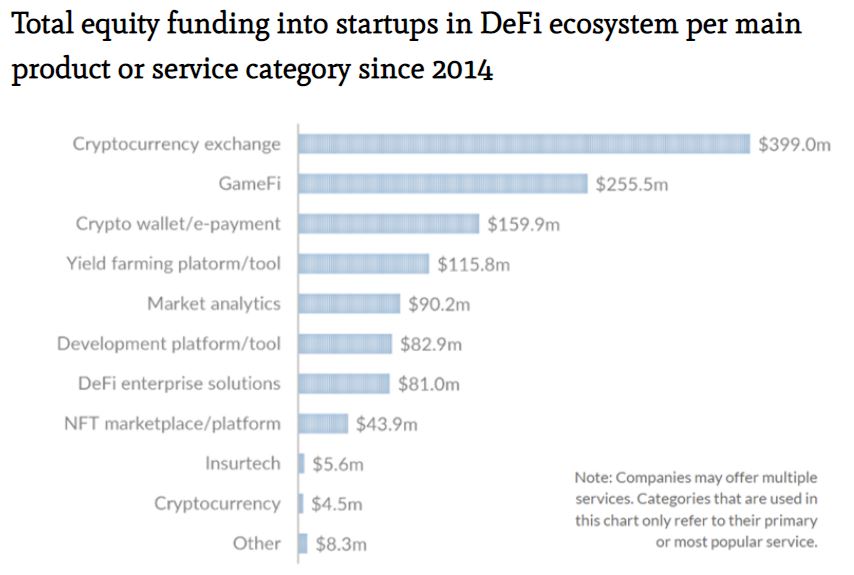

According to data compiled by DealStreetAsia, tech firms operating in Southeast Asia’s DeFi ecosystem have raised almost $1 billion this year. This figure is more than six times the capital raised throughout 2020. The flow of funds reportedly incentivized new innovations in the form of new protocols and infrastructure dedicated to enhancing scalability and interoperability.