Coinbase has filed a case in the US Federal Court, aiming to compel the SEC in answering yes or no to a petition pending since July 2022. The petition in discussion requested the SEC to propose clearer regulatory guidelines for the crypto industry throughout the US. Coinbase argues that the sole purpose of rulemaking is to help agencies in developing regulations with the benefit of public input and also to have their overall position tested through judicial review.

In the petition, Coinbase urged the SEC to answer a total of 50 questions, which revolved around the overall regulatory treatment of a number of digital assets. Some of these questions asked the SEC to provide proper clarification regarding how tokens are securities. The rest of these questions asked for clearer guidelines for the sale and purchase of different cryptocurrencies on SEC-regulated exchanges.

It is almost a year and Coinbase did not get any proper answers from the SEC, therefore, it has started poking the regulatory authority. The firm believes that the SEC has made up its mind not to give it a proper answer, so the exchange asked the court to pressurize the regulatory body in sharing its decision.

Coinbase added,

“From the SEC’s public statements and enforcement activity in the crypto industry, it seems like the SEC has already made up its mind to deny our petition. But they haven’t told the public yet. So the action Coinbase filed today simply asks the court to ask the SEC to share its decision.”

The SEC Vs. Coinbase Saga

Coinbase is among the many different crypto firms that have been subject to increased scrutiny from the SEC following the market meltdown of last year. Kraken reached a settlement with the regulatory body over its staking services and also agreed to halt the offering in the US.

Similarly, Bittrex was recently served legal notice over the allegation of operating an unregistered securities exchange. Coinbase made it evident that proper regulatory clarification is still long overdue, as many crypto companies fear regulatory crackdowns in the near future

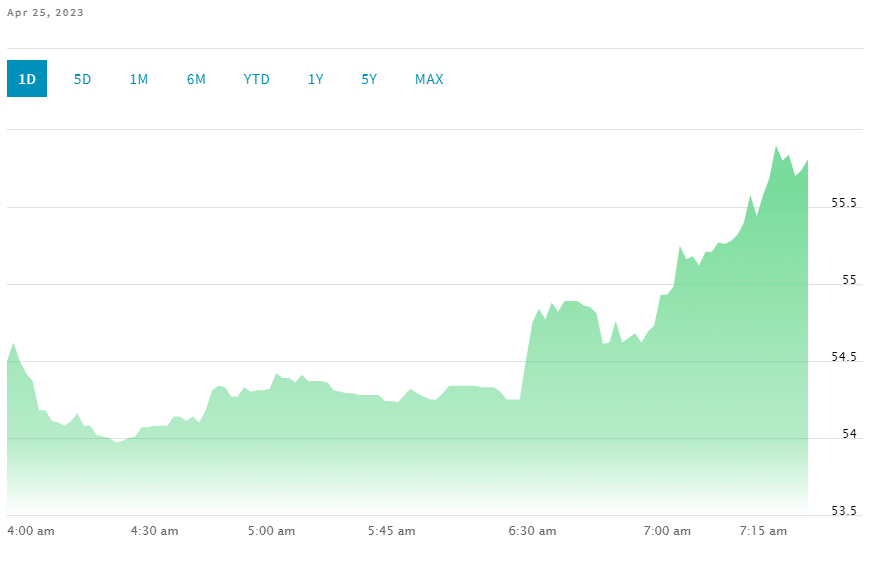

As long as the stock of Coinbase is concerned, the overall situation does not look too pretty. At the time of writing, the COIN stock is trading on NASDAQ for approximately $54.75, signifying a decline of 7.27% over the previous 24 hours. However, the masses believe that the situation would change for the better if the court rules in the favor of the crypto exchange.

Despite the increased crackdowns, Coinbase and other exchanges have mentioned escalating plans for overseas expansion. The exchange received a license to operate in Bermuda, and it is expected that a derivatives exchange would be launched there sometime this week.