TL;DR

- Uniswap transferred 9 million UNI to Coinbase Prime, accumulating $60.99 million in movements over the past six days.

- Institutional investors liquidated 515,740 UNI, and the spot market sold $14.98 million in one week, increasing downward pressure.

- Despite the sell-offs, Uniswap’s TVL rose by $66 million since April 26, reaching $4.009 billion according to DeFiLlama.

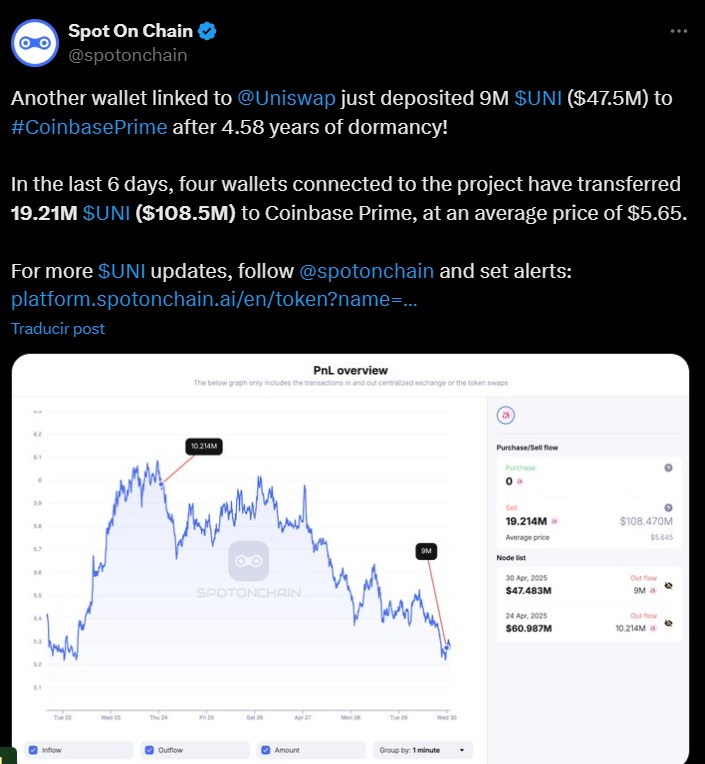

Uniswap drew market attention again after moving a significant amount of UNI tokens to Coinbase Prime, a platform used by institutional investors for over-the-counter trades.

A total of 9 million UNI, equivalent to $47.5 million, was sent. This transaction added to four others carried out over the past six days, totaling $60.99 million in transferred assets.

Although the operation could be seen as a sign of institutional interest, investor reaction went the opposite way. Instead of viewing the move as an opportunity, many chose to exit their positions in UNI. Data shows that whales liquidated 515,740 tokens, valued at $2.74 million. This was compounded by selling pressure in spot markets, where $14.98 million was offloaded in just one week.

Uniswap Grows Despite Market Distrust

Market behavior suggests distrust regarding the project’s management decisions. However, despite the sell-offs, Uniswap experienced a rebound in its total value locked (TVL). Since April 26, it has increased by $66 million, reaching $4.009 billion according to DeFiLlama. This figure highlights a disconnect between market activity and the health of the protocol’s DeFi infrastructure.

Market Expectations for New ETFs

Meanwhile, the crypto market remains focused on regulatory decisions in the United States. The Securities and Exchange Commission (SEC) postponed until June 17 its ruling on several cryptocurrency ETFs, including the XRP proposal from Franklin Templeton. Although the delay was expected, approval expectations for the new products remain high.

According to Bloomberg, ETFs for Solana, Litecoin, and crypto index funds have a 90% probability of approval. For XRP, Hedera, and Dogecoin, estimates range between 80% and 85%. Meanwhile, Avalanche, Polkadot, and Cardano maintain a 75% approval outlook.

At the same time, Santiment reported significant XRP accumulation by whales, who acquired over one billion tokens in the past 48 hours. This behavior fuels speculation of a potential recovery, though its price faces resistance in the $2.4 to $2.5 range