TL;DR

- Coinbase will launch prediction markets and tokenized stocks on December 17, with the infrastructure already developed.

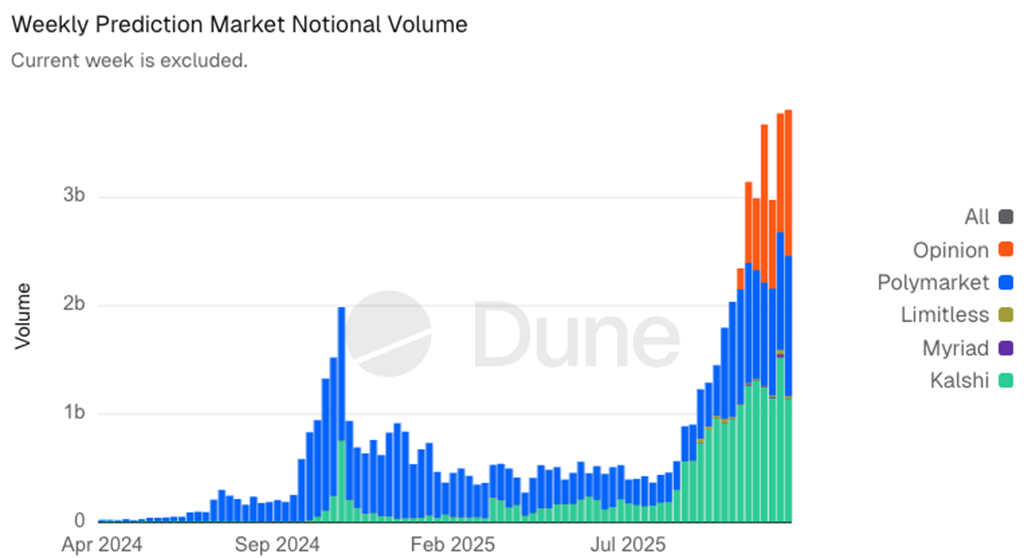

- The company joined the Coalition for Prediction Markets to offer regulated markets in a sector that grew from $1.3B to $7.7B in monthly volume.

- Other exchanges are moving in the same direction; Gemini received CFTC approval, and Crypto.com launched a market in partnership with Fanatics.

Coinbase will roll out prediction markets and tokenized stocks next week, Bloomberg reported.

The company is preparing a livestream event on December 17 to showcase both products, developing the tokenized equities platform internally without external partners. Coinbase’s app has already shown screenshots of the new features, anticipating the arrival of these tools in the firm’s ecosystem.

Coinbase enters the prediction market space to capitalize on its widespread popularity. The market is currently dominated by Kalshi and Polymarket, whose combined volumes rose from $1.3 billion in August to $7.7 billion in November. The company joined the Coalition for Prediction Markets (CPM) alongside Kalshi and other U.S. firms, aiming to provide a secure, regulated service for American users. According to Faryar Shizad, the exchange’s chief policy officer, prediction markets democratize the search for information and allow decisions based on verifiable facts.

Coinbase Already Developed the Infrastructure for Its New Products

Other major exchanges in the industry are following the same path. Gemini received CFTC approval to operate as a Designated Contract Market, enabling it to offer event contracts, while Crypto.com partnered with Fanatics to launch a fan-focused prediction market. The sector’s expansion appears unstoppable, with weekly volume reaching a record near $4 billion last week, according to Dune Analytics.

Coinbase had already demonstrated its technological readiness for these launches. Research by Jane Manchun Wong revealed landing pages for tokenized equities and prediction markets offered by Kalshi, confirming that the company has the infrastructure ready to deploy these products. The firm aims to expand its offering within the U.S. digital finance ecosystem, integrating new tools that combine asset tokenization with market mechanisms based on real-world events.

High Potential and Fierce Competition

Kalshi, founded in 2018 by MIT graduates Tarek Mansour and Luana Lopes Lara, allows users to trade real-world event outcomes like financial assets and remains a central player in the ecosystem alongside Polymarket and Opinion.

Coinbase will begin integrating these tools into its ecosystem, aiming to position itself among the leaders of a market that, for now, still has significant potential to realize