TL;DR

- Coinbase acquired Deribit for $2.9 billion in the largest deal in the crypto industry to date, combining cash and company stock.

- The acquisition will boost its global presence and strengthen its institutional offering in a derivatives market with growing demand.

- Deribit dominated BTC and ETH options trading with $1.2 trillion in volume in 2024.

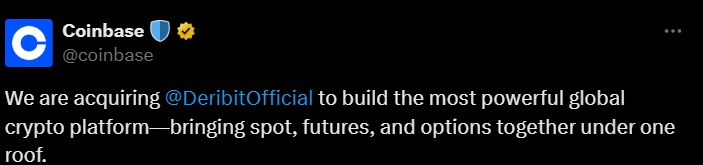

Coinbase has confirmed the acquisition of Deribit, one of the leading crypto derivatives exchanges, in a $2.9 billion deal. The transaction includes $700 million in cash and 11 million Coinbase shares, marking the largest deal ever recorded in the crypto industry.

With this move, the U.S.-based company will expand its global footprint and enhance its range of products aimed at institutional clients, in a derivatives market where demand for digital asset products continues to rise as regulatory frameworks become clearer.

Deribit’s Numbers

Deribit leads the Bitcoin and Ethereum options market, posting $1.2 trillion in trading volume in 2024. Its offering includes perpetual swaps, European-style options, and advanced tools designed for institutional and algorithmic traders. This acquisition will allow Coinbase to integrate specialized infrastructure for complex financial products, positioning itself to compete in segments where firms like CME and Binance have traditionally dominated.

Benchmark analyst Mark Palmer highlighted that Deribit consistently maintains the highest levels of open interest and trading volume in crypto derivatives. He also praised its real-time market data services, tailored for high-frequency traders. Following the announcement, Benchmark reaffirmed its buy rating for Coinbase shares and raised its price target to $252.

Coinbase Seizes a Unique Growth Opportunity

Spencer Yang, former Coinbase executive and current co-founder of Fractal Bitcoin, called the acquisition a strategic opportunity to accelerate the company’s international expansion. He also noted that Deribit is the only independent platform naturally suited to integrate with Coinbase’s operational model.

Institutional interest in crypto derivatives is soaring, especially in offshore markets where perpetual contracts consistently outperform spot trading volumes. In 2024, Bitcoin and Ethereum futures reached $31 trillion outside the U.S., while the domestic market handled roughly $2.5 trillion.

Acquiring Deribit will give Coinbase immediate access to that global flow, bolster its Prime offering, and cover the full range of regulated and non-regulated products. It also strengthens its operational capacity at a time when several exchanges and brokers are moving toward integrated multi-asset digital platforms