TL;DR

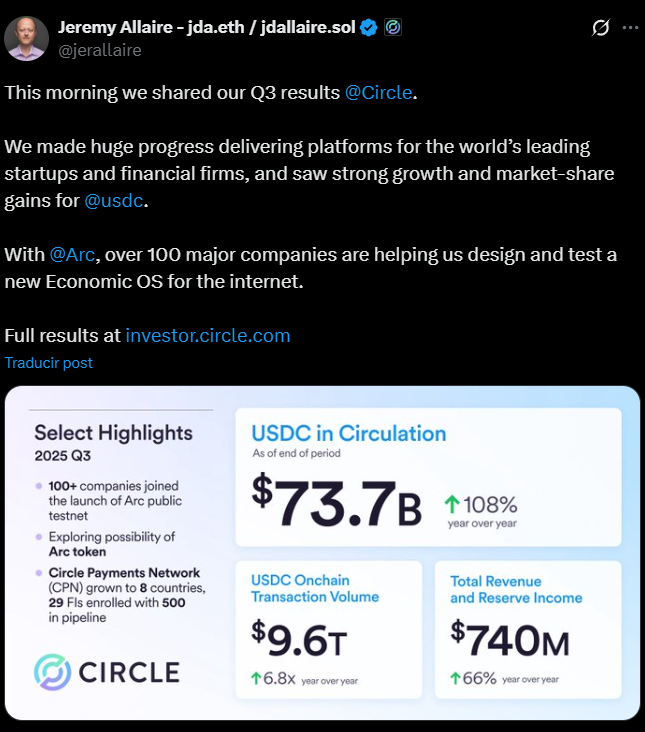

- Circle reported $740 million in Q3 revenue, up 66% year-over-year, with a net profit of $214 million.

- The company is developing Arc Network, its Layer-1 blockchain focused on programmable financial infrastructure.

- Its tokenized payments network (CPN) includes 29 active institutions and $3.4 billion in annualized volume.

Circle closed a record quarter marked by revenue growth, expanding institutional adoption, and the consolidation of its proprietary infrastructure, Arc Network — a blockchain designed to bring traditional finance into the programmable era.

The company posted $740 million in total revenue and reserve income for fiscal Q3 2025, a 66% increase from the prior year. Net income surged 202% to $214 million, while adjusted EBITDA rose 78% to $166 million. USDC circulation, its flagship stablecoin, climbed 108% year-over-year to $73.7 billion, with an average of $67.8 billion in circulation during the quarter.

A New Economic Operating System for the Internet

Jeremy Allaire, Circle’s co-founder and CEO, said the company is building “the new economic operating system for the Internet,” where digital dollars integrate with global technological infrastructure to move capital with greater trust and transparency.

At the same time, Circle is advancing its own Layer-1 network. The Arc public testnet, launched in late October, already counts over 100 participating companies from the banking, payments, and digital asset sectors. Circle is exploring the launch of a native token to align incentives between developers and institutions, aiming to establish Arc as an open and programmable foundation for tokenized financial products.

Institutional growth is also reflected in its tokenized payments network (CPN), which now includes 29 active financial institutions, 55 under review, and more than 500 in the onboarding process. Operating across eight countries, the network has processed an annualized transaction volume of $3.4 billion since May. Key partners include Visa, Kraken, Deutsche Börse Group, Finastra, Brex, Itaú Unibanco, Fireblocks, and Hyperliquid.

Circle Stock Drops Amid Broader Crypto Market Weakness

Its tokenized money market fund (USYC) surpassed $1 billion in assets after growing more than 200% since June. Circle expects to maintain a 40% compound annual growth rate in USDC circulation and raise its other revenue to as much as $100 million by year-end.

The announcement of a potential native token for Arc coincided with a 3% drop in Circle’s stock (CRCL), pressured by broader crypto market weakness. Still, the company heads into 2026 with a solid balance sheet, growing institutional demand, and a central role in bridging stablecoins with traditional finance