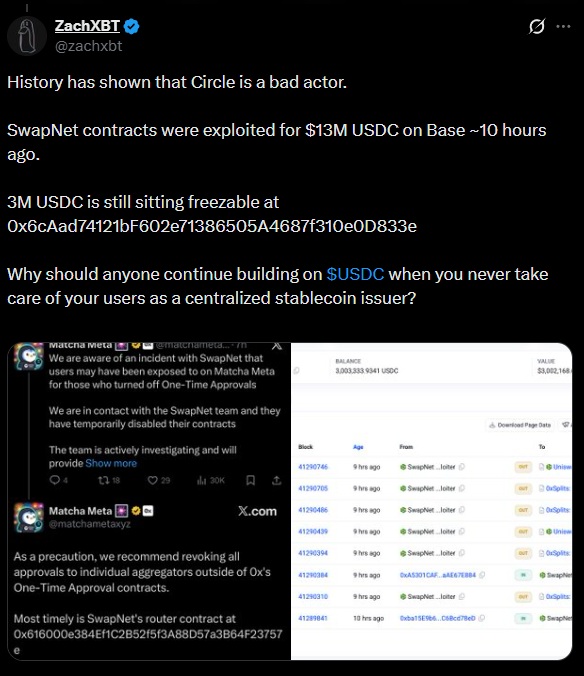

Circle is facing heavy criticism for failing to immediately block stolen funds. Over $3 million in USDC, taken from SwapNet users, remain in a Basescan address without being frozen by the company.

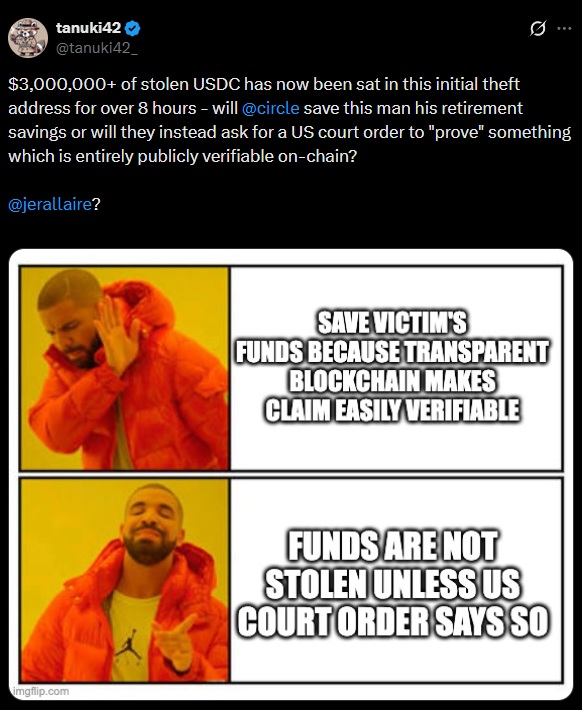

An independent researcher known as “Tanuki42” tagged Circle and its CEO, questioning whether they are waiting for a court order to “prove” something that is publicly verifiable on the blockchain. Another analyst, ZachXBT, called the company a “bad actor” and highlighted that the lack of action affects stablecoin users.

Attackers often convert centralized stablecoins, such as USDC or USDT, into assets that cannot be frozen, including DAI or ETH, which can be laundered through mixers like Tornado Cash.

The firm has been criticized previously for similar incidents, including the $42 million GMX hack and the laundering of funds stolen by North Korean hackers from ByBit. According to an AMLBot Dune dashboard, Circle has frozen only $110 million from fewer than 500 addresses, while Tether froze $1.6 billion across more than 2,500 addresses.

Source:

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions