TL;DR

- Circle debuted on the New York Stock Exchange at $31 per share, raising $1.05 billion after increasing its initial offering due to strong demand.

- ARK Investment plans to invest up to $150 million in the company’s stock following its market debut.

- Circle operates exclusively with stablecoins, with no apps or financial services, making it one of the few crypto infrastructure firms publicly traded on Wall Street.

Circle began trading this Thursday on the New York Stock Exchange with an opening price of $31 per share. The company, known for issuing the USD Coin (USDC) stablecoin, raised $1.05 billion after placing 34 million shares in its initial public offering. Demand exceeded expectations, forcing the company to increase the size of the issuance twice before the market opened.

The deal was led by JPMorgan, Goldman Sachs, and Citigroup, who also secured a 30-day option to sell an additional 5.1 million shares. If investor interest holds, Circle could further increase the capital raised in its market debut.

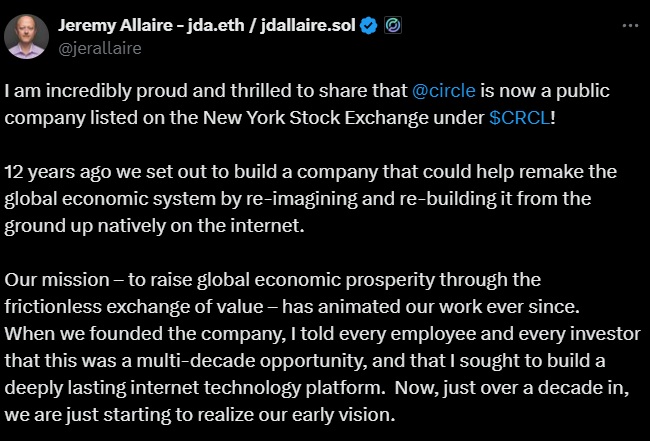

Founded 12 years ago by Jeremy Allaire, the company decided this year to move its headquarters from Boston to New York. Allaire himself celebrated the IPO with a post on social media, highlighting the opportunity to transform the financial system through infrastructure designed for the internet. Circle has built its business exclusively around USDC, an asset backed by reserves such as Treasury bonds, which currently accounts for 27% of the stablecoin market. Only Tether holds a larger share, with 67%.

Circle: A Unique Company on the Exchange

Unlike other firms linked to the digital financial sector, Circle doesn’t offer brokerage services, payment accounts, or app-based financial products. Its model focuses solely on issuing and managing stablecoins, making it one of the few publicly traded crypto infrastructure companies in the United States.

Cathie Wood, CEO of ARK Investment Management, announced her intention to acquire up to $150 million in Circle shares. That interest was a key factor behind the decision to increase the offering size. In 2024, the company reported $1.68 billion in revenue and $156 million in net profit. Although this figure fell short of the $268 million recorded in 2023, the business remains profitable — a rare condition among tech companies that have gone public in recent years.

The IPO market in the United States began to recover this year after a long slowdown. Following the steps of companies like eToro and CoreWeave, Circle now joins that trend