TL;DR

- Circle and OKX launched fee-free conversions between USDC and dollars at a fixed 1:1 rate within the exchange platform.

- OKX operates on twelve networks compatible with USDC and has banking partnerships with institutions like Standard Chartered and DBS.

- In addition to strengthening USDC liquidity, OKX supports USDT and is negotiating new partnerships to expand its stablecoin offerings.

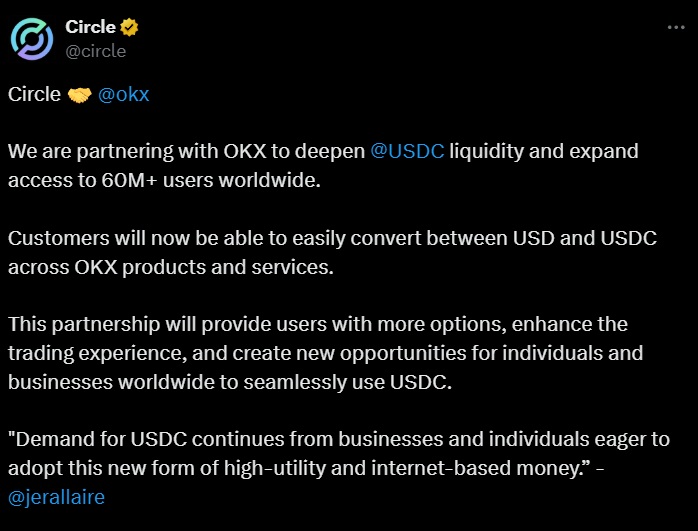

Circle and OKX announced a partnership to offer fee-free conversions between USDC and dollars within the exchange platform.

This initiative allows users to swap between the two currencies at a fixed 1:1 rate, removing intermediaries and costs that previously complicated such transactions. The agreement aims to improve stablecoin accessibility and facilitate their use in digital financial systems.

OKX integrates twelve of the twenty-three networks compatible with USDC, including Ethereum, Solana, Arbitrum, Base, and Optimism. This enables conversions across a broad range of chains, although the measure does not affect network fees associated with on-chain transfers. The goal is to eliminate common barriers, such as order book depth differences and swap costs, by providing a direct, commission-free tool to enter and exit stablecoin positions.

OKX Works with Support from Several Internationally Recognized Banks

To implement this integration, OKX relies on banking partnerships with institutions such as Standard Chartered, DBS, and Bank Frick, as well as payment solutions like Apple Pay and PayPal. This network of partners simplifies fiat on- and off-ramps on the platform, streamlining operations for both retail and institutional users. According to the exchange, any user holding USD and USDC balances will be able to access this benefit.

Both companies also announced the development of educational content and outreach programs focused on stablecoins and their practical application in digital transactions. The goal is to familiarize more users with using USDC for payments, trading, and Web3 solutions.

OKX will continue supporting other stablecoins. The exchange manages over $330 million in daily volume for pairs like ETH/USDT and confirmed ongoing talks with Tether to explore future collaborations