TL;DR:

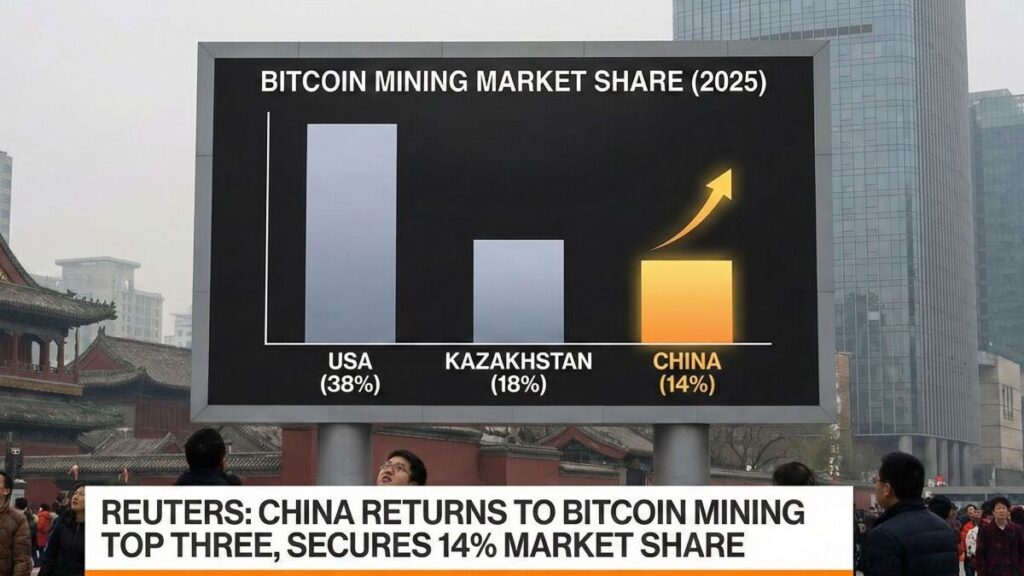

- China reclaims third place in global Bitcoin mining, capturing 14% of total capacity.

- Cheap electricity, excess data center space, and rising domestic mining rig sales fuel underground growth.

- Softened policy signals and yuan-backed stablecoin discussions encourage miner confidence despite revenue pressure from low hashprice.

China has quietly returned to the global Bitcoin mining scene, claiming the third-largest share of worldwide mining with 14% as of October 2025. Despite the official ban on cryptocurrency mining in 2021, underground operations are flourishing, fueled by cheap electricity and excess data center capacity in regions such as Xinjiang and Sichuan. Former miners are returning, and new projects are emerging, reflecting a significant revival of activity.

China’s Underground Expansion and Market Drivers

Miners cite abundant and inexpensive power as the main driver behind this resurgence. Data provider CryptoQuant estimates that 15–20% of global mining capacity now operates in China. Companies like Canaan, a leading mining rig manufacturer, report a sharp rebound in domestic sales, supported by rising Bitcoin prices and uncertainty over U.S. tariffs that slowed overseas demand. These factors collectively incentivize both new and returning miners to participate in China’s re-emerging ecosystem.

Policy signals appear to be softening, contributing to renewed confidence. Hong Kong’s stablecoin legislation and discussions about yuan-backed stablecoins indicate a more flexible stance on digital assets. Although the government has not officially reversed the ban, the environment now tolerates limited mining operations, particularly where infrastructure and electricity costs remain favorable.

Bitcoin’s hashprice has recently dropped to a record low, reflecting weaker prices, low transaction fees, and elevated network difficulty. Luxor data reports a hashprice of $34.2 per PH/s, highlighting pressures on miner revenue even as overall global capacity increases. The next difficulty adjustment, projected to decline by just over 2%, may slightly alleviate some of the revenue pressure.

China’s reentry into the mining landscape underscores the resilience of its ecosystem and the ongoing appeal of low-cost power for cryptocurrency operations. The underground expansion demonstrates how regional advantages and market incentives can drive mining growth even under restrictive policies. Analysts predict that this trend could influence global mining dynamics, particularly as miners balance profitability with regulatory risks.