TL;DR

- Charles Hoskinson called for the shutdown of the Cardano Foundation after accusations of a $600 million ADA misappropriation, though an independent audit cleared him.

- The conflict risks creating deeper divisions within the ecosystem and raises questions about governance.

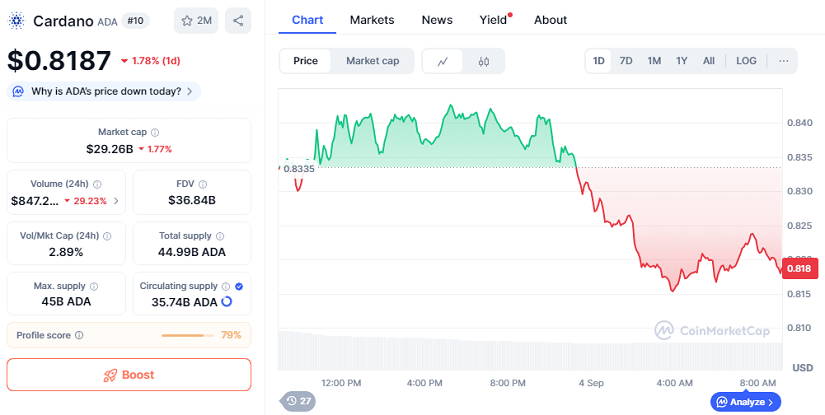

- Meanwhile, ADA trades at $0.8187 with a 24-hour decline of 1.78% and a market capitalization of $29.26 billion.

Cardano is once again under the spotlight after its founder, Charles Hoskinson, urged the dissolution of the Cardano Foundation. The demand follows weeks of escalating tension after allegations surfaced claiming that insiders had misappropriated over 300 million ADA tokens, valued at more than 600 million dollars when the accusations first appeared.

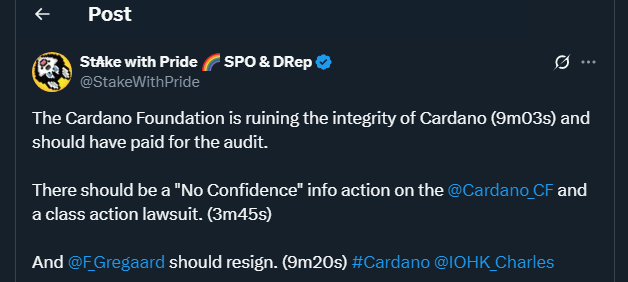

Hoskinson expressed his frustration during a live session on X, criticizing the Foundation for what he called “ruining the integrity of the ecosystem.” He suggested that the entity’s assets could be redirected to the Cardano treasury or to other organizations capable of contributing to the blockchain’s long-term growth.

Independent Audit Clears Hoskinson

To counter the controversy, Hoskinson commissioned an independent audit to review the claims. The report concluded that none of the accusations had factual basis. It clarified that part of the unredeemed ADA from early investors was allocated to a trust fund, Intersect, co-founded by Input Output and EMURGO, which played a role in overseeing Cardano’s roadmap.

The findings appear to dismiss the narrative of embezzlement, but Hoskinson’s sharp criticism of the Cardano Foundation for spreading these allegations has triggered deep divisions. The Foundation has not issued a detailed response, but the lack of support for the audit and the ongoing dispute raise concerns about governance within one of the most ambitious blockchain projects.

Market Sentiment And ADA Price

Cardano’s native token, ADA, has already shown signs of stress in market sentiment. According to on-chain analytics, optimism among holders has waned, with crowd behavior tilting toward bearishness. At the time of writing, ADA trades at 0.8187 dollars, down 1.78% in the last 24 hours, with a market capitalization of 29.26 billion dollars.

Despite the fear-driven outlook, some analysts note that ADA prices historically move opposite to prevailing sentiment, leaving the door open for a potential recovery. On liquidity heatmaps, support appears near 0.80 and 0.76, while resistance levels are clustered at 0.85 and 0.90.

The ongoing clash between Hoskinson and the Foundation could shape both governance and investor confidence. Whether the conflict weakens or ultimately strengthens Cardano’s trajectory may depend on how quickly transparency and trust are restored.