TL;DR

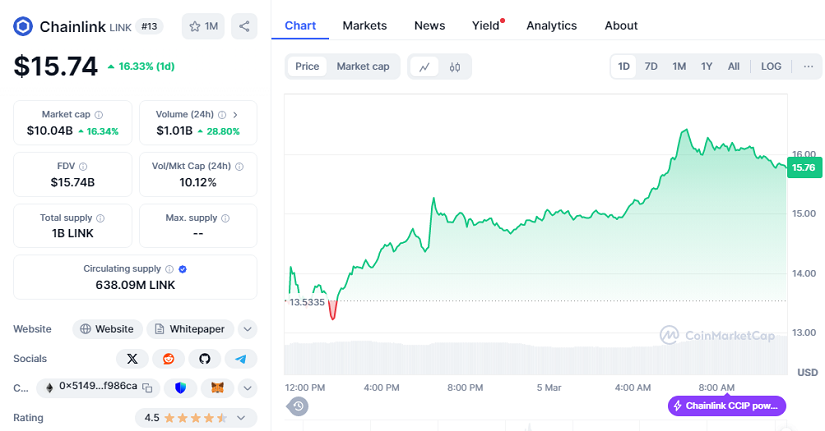

- Chainlink (LINK) has surged 16.33% in the last 24 hours, reaching $15.74, with a market cap of $10.04 billion.

- Technical analysis highlights key support and resistance levels, with the $16.34 target if the bullish trend continues.

- Rising trading volume and open interest suggest growing investor confidence, reinforcing optimism in LINK.

Chainlink (LINK) has shown an impressive recovery in the last 24 hours, with a 16.33% increase in its price, reaching $15.74, which has reignited expectations of a potential new bull cycle. This surge has been supported by a significant increase in transaction volume, indicating that demand for LINK is on the rise.

The price of LINK had recently dropped to $13.18, but today’s rally could be a sign that the correction is nearing its end. With a 13.6% decline from its high of $16.34, the previous drop may have been a profit-taking move that is now being corrected, pushing the price back toward key resistance levels. If the price holds the support at $13.18, it could signal a long-term bullish trend. Many analysts believe that LINK’s potential as an essential oracle network could drive its value higher over time.

Technical Indicators and Volume Momentum

Fibonacci retracement levels remain relevant, with the $15.00 mark being an important threshold that LINK has already surpassed. If the cryptocurrency manages to stay above $15.00 and hits the next target at $16.34, it could consolidate into a new bullish phase. Moreover, the surge in trading volume, which has more than doubled its 9-day average, is a clear indication that investors are increasing their positions in LINK. Such volume behavior typically accompanies periods of strong price growth, signaling a shift in market sentiment.

With a market capitalization of $10.04 billion, Chainlink remains one of the strongest cryptocurrencies in the oracle space.

Another relevant factor is the open interest, which has been rising in recent days, suggesting that more investors are opening long positions. This reinforces the idea that LINK could be on track for new highs. If open interest continues to rise above current levels, the price could keep climbing toward $16.34 and, if the trend continues, reach $17.00. Additionally, the increasing interest from institutional investors adds credibility to the bullish outlook for LINK’s future performance.

Therefore, if the bullish trend holds, Chainlink’s price could continue its ascent, but it will be crucial to monitor support and resistance levels to adjust investment strategies.