TL;DR

- Chainlink fell 4% and is trading near $22.68 after hitting $23.79, driven by strong community enthusiasm and high network activity.

- The network secures over $62 billion in total value and controls 61% of the oracle market, with 453 active projects across 21 chains.

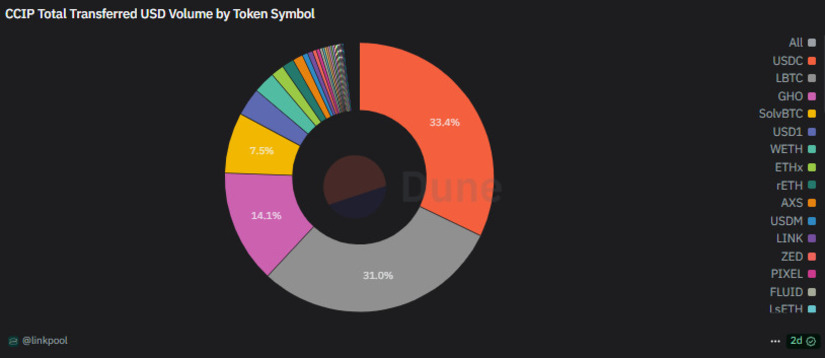

- CCIP protocol usage has been growing since July, with higher transfer volumes in USDC and LBTC and heavy activity on Arbitrum and Base.

Chainlink is undergoing a correction after a rally that pushed it to its highest value in three months. After reaching $23.79 on a wave of community enthusiasm, the token fell 4% in recent hours and is now trading near $22.68. The pullback follows several days in which network activity and demand for its services hit 2025 highs.

The project has benefited from increased demand for oracles supporting ETF products and real-world asset tokenization, markets that require precise, low-latency data. In addition, its technology was highlighted in official White House documents on digital assets, giving the project additional exposure.

During the previous rally, a direct purchase from a wallet linked to the Chainlink team added buying pressure. That transaction, executed on Uniswap V3, acquired more than 40,000 tokens in just one hour, according to Etherscan records. The surge coincided with a rise in daily network transactions, as the number of active addresses remains relatively low but with a high frequency of transfers.

Chainlink Holds an Unmatched Lead Among Oracles

Chainlink has cemented its dominance in the oracle market, securing over $62 billion in total value and accounting for roughly 61% of market share. Its infrastructure supports 453 projects across 21 blockchains, focusing on highly liquid protocols. No competitor has managed to overcome the first-mover advantage it has held since its earliest deployments.

In the tokenized asset sector, Chainlink holds a $15.9 billion market cap out of the market’s $57 billion total. Despite a 5% overall decline in this sector over the past three months, the token has managed to expand its presence. It is also listed among the top ten assets under the “Made in USA” regulatory narrative, supported by a more favorable legal framework in the country.

Another major driver of activity for Chainlink is the use of its CCIP protocol, which streamlines cross-chain transfers and has grown in prominence since July. Most of this traffic comes from moving stablecoins like USDC and LBTC, along with activity on layer-2 solutions such as Arbitrum and Base