TL;DR

- Chainlink has launched an onchain LINK reserve that has already surpassed $1 million and is funded by both onchain and offchain revenue.

- Automatic conversion to LINK is handled through Payment Abstraction, which now also processes offchain payments from contracts with large enterprises.

- 50% of fees from staking-based services will go to the Reserve, while the network adjusts its infrastructure to reduce costs and support long-term growth.

Chainlink has introduced a new economic initiative with the launch of the Chainlink Reserve, an onchain reserve of LINK tokens funded by revenue from both onchain services and offchain enterprise agreements.

The goal is to ensure the network’s long-term sustainability through the gradual accumulation of LINK, with no plans for withdrawals in the short term. In this initial phase, the Reserve has already surpassed $1 million and is expected to continue growing as more revenue sources tied to service usage are integrated.

Chainlink: Payment Abstraction

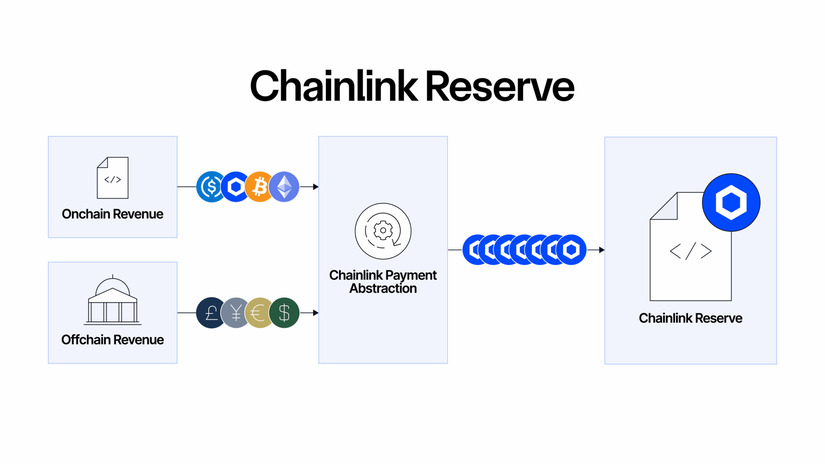

The infrastructure enabling this automatic conversion is Payment Abstraction—a system that processes payments in various assets, such as stablecoins or gas tokens, and converts them to LINK using Chainlink services and decentralized exchanges like Uniswap V3. This tool, which was already in use for onchain revenue, now also accepts offchain payments from enterprise contracts using LINK to connect legacy systems with blockchain networks.

The expanded Payment Abstraction system includes automated conversion processes, cross-chain payment consolidation, and price validation using official oracles. Additionally, a new allocation was introduced: 50% of the fees from staking-secured services will now be directed to the Reserve, strengthening its financial backing. To improve transparency, a public dashboard was launched to track the Reserve’s growth.

Infrastructure Focused on Efficiency

The launch of the Reserve aligns with other efforts to balance revenue and costs. The network already collects usage-based payments, shares fees with protocols like Aave and GMX, and supports early-stage projects through a program that receives part of their native token supply. At the same time, Chainlink continues to optimize its infrastructure to lower operating expenses. The adoption of a new modular execution environment enables more efficient use of technical resources by eliminating redundant oracle networks and streamlining internal processes.

The creation of the Reserve signals a shift in the project’s economic approach. Chainlink aims to sustain the growth of its network within the financial sector, where its services are beginning to serve as core infrastructure