TL;DR

- Chainlink, JPMorgan, and Ondo Finance completed the first cross-chain settlement of tokenized bonds with simultaneous fiat payment between a private network and a public blockchain.

- The operation used the Chainlink Runtime Environment to coordinate transaction instructions without moving funds across chains, reducing risk and settlement time.

- The tokenized asset market surpassed $23 billion in 2025, with private credit and tokenized Treasury bonds leading this fast-growing category.

Chainlink, JPMorgan, and Ondo Finance successfully executed a cross-chain operation linking a private payment network with a public blockchain specialized in tokenized real-world assets.

The transaction involved an exchange of tokenized U.S. Treasury bonds for fiat payment, settled simultaneously through a delivery-versus-payment mechanism. The process was managed via Kinexys, JPMorgan’s digital payments platform, and the Ondo Chain testnet, built to handle real-world assets within decentralized environments.

Chainlink Runtime Environment

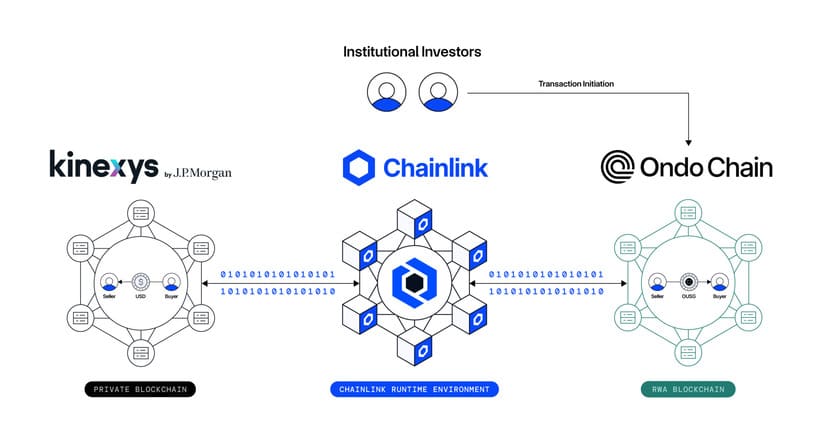

At the core of this operation was the Chainlink Runtime Environment, an off-chain solution that coordinates transactions across networks with different permission levels. This intermediary layer verified escrow events on the public blockchain, executed payment instructions within the private network, and completed the final settlement without transferring funds directly between chains. Only transaction instructions moved across networks, minimizing counterparty risk and streamlining settlement processes.

This was the first transaction of its kind on the Ondo Chain testnet and expanded Kinexys’ settlement capabilities beyond private systems. The infrastructure also supports transactions of varying complexity, from single-network operations to simultaneous settlements across multiple blockchains. This enables traditional institutions to conduct tokenized asset operations without compromising security or speed.

RWA Market on the Rise

The market for tokenized real-world assets continues to expand, and solutions like Chainlink’s are becoming both essential and widely adopted. In the first half of 2025, the total value of RWAs exceeded $23 billion, a growth of more than 260% since the start of the year. Tokenized private credit led the sector with a 58% share, followed by tokenized Treasury bonds at 34%.

New firms keep entering the space. On June 5, asset manager APS acquired €3 million in tokenized bonds backed by Italian residential properties through MetaWealth. The development of new tools within the Chainlink, Ondo, and related ecosystems will be key to sustaining the momentum of this rapidly growing market