TL;DR

- Cathie Wood, CEO of ARK Invest, predicts that Bitcoin could reach $1.5 million by 2030, driven by institutional adoption and growing demand as an asset class.

- The prediction is based on a compound annual growth rate (CAGR) of 58% over the next five years.

- However, Bitcoin’s price must surpass $100,000 to ensure a steady upward trajectory toward the $1.5 million target.

Cathie Wood, CEO of ARK Invest, continues to capture attention with her optimistic vision for Bitcoin’s future. In a recent video released on February 11th, Wood shared her bold prediction that Bitcoin could reach as high as $1.5 million by 2030. This projection is based on the increasing interest from institutional investors, who are now viewing Bitcoin not only as a speculative investment but also as a key asset class for portfolio diversification.

Institutional Adoption as a Growth Driver

According to Wood, the “institutionalization” of Bitcoin is gaining momentum. Financial institutions and investment funds have started adding Bitcoin to their portfolios, attracted by its appealing risk-return profile, which stands in stark contrast to traditional assets. This shift could have a significant impact on Bitcoin’s price in the long run, especially as more institutions embrace cryptocurrencies.

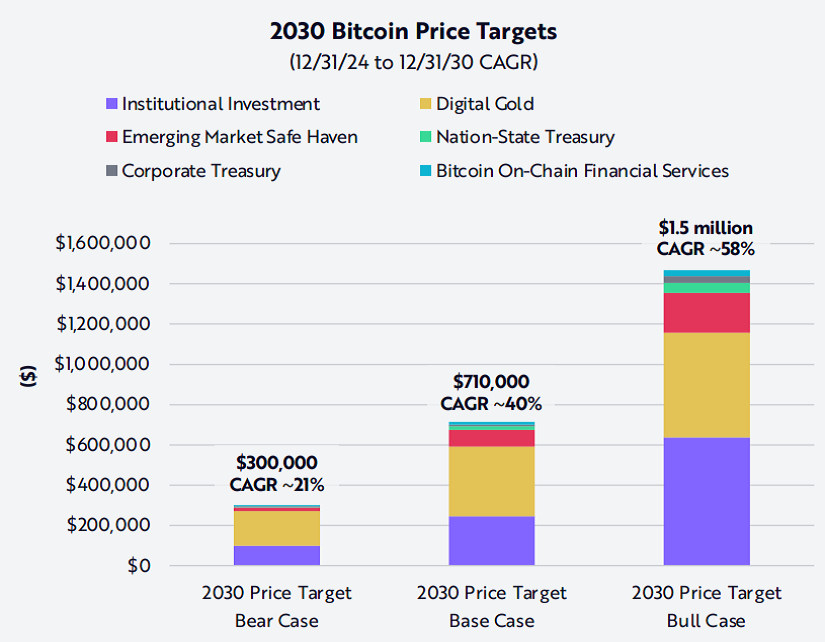

Although Bitcoin has been trading below the critical $100,000 level since early February, the outlook for explosive growth remains intact. Wood’s prediction assumes that Bitcoin will experience a compound annual growth rate (CAGR) of 58% over the next five years, pushing its price to the ambitious $1.5 million mark. However, ARK Invest also maintains a more conservative base case, which places the price at $710,000, assuming a lower 40% growth rate.

In the event of a pessimistic scenario, ARK forecasts Bitcoin could reach $300,000 by 2030, with a CAGR of 21%. Despite market fluctuations and an uncertain global economic environment, many analysts believe Bitcoin’s future remains promising.

The Path Toward $100,000 and Beyond

However, Bitcoin’s price must break the psychological barrier of $100,000 in order to continue its climb toward these historic levels. According to Iliya Kalchev, an analyst at Nexo, Bitcoin needs to surpass this threshold to avoid short-term selling pressure and pave the way for a potential bull rally driven by a “surge in demand” and a “supply shock”. With only around 2.5 million BTC remaining on exchanges, if the market experiences this type of imbalance, price appreciation could become inevitable.

With the growing institutional adoption and the scarcity of supply, Bitcoin could be poised to enter a new era of growth.