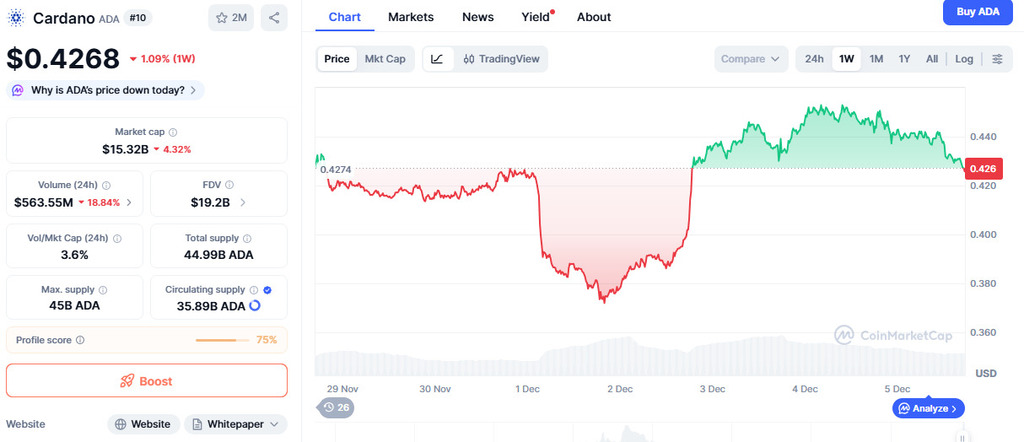

Cardano (ADA) has traded around $0.44 for several months. Some holders view the sideways movement as a sign of limited near-term momentum, while others interpret it as consolidation.

Digitap ($TAP) is positioning itself as an “omni-bank” product that combines crypto features with payments and other finance-related tools in one platform, according to project materials. Any assessment of future adoption or market performance remains uncertain.

ADA’s slow momentum and competing narratives around newer projects

Cardano is supported by a large community and is known for an academic approach to blockchain development. At the same time, market interest can vary over time, and price performance does not necessarily track technical progress.

The token is currently hovering around $0.44, which some market participants treat as a notable level. Whether that level holds or breaks can depend on liquidity, broader market conditions, and incoming demand.

Some investors describe Cardano as being in a consolidation phase, while others argue the project has faced challenges translating research-led development into faster-growing on-chain activity compared with newer ecosystems.

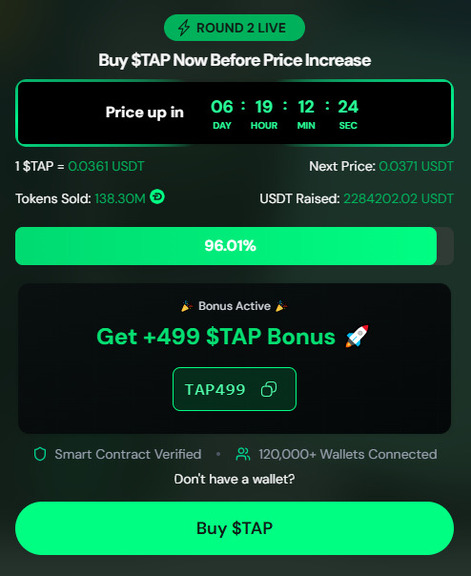

Against that backdrop, Digitap is marketing $TAP as part of an early-stage fundraising effort. The project has also said it has a Visa-related integration intended to support spending use cases; the scope, availability, and timelines of any integrations should be verified independently.

Utility narratives heading into 2026

“Utility” remains a recurring theme in crypto markets, though adoption trends can shift quickly and are difficult to forecast. Payments-focused products are often cited as one possible route to broader usage, but outcomes depend on regulation, user demand, and execution.

Digitap describes its omni-bank ecosystem as combining payments, identity, savings and spending features, cross-border tools, and crypto-related services into one app. These are project-stated plans and should be assessed against publicly available documentation and product availability.

More broadly, comparisons between established networks such as Cardano and early-stage projects can be misleading because they differ in maturity, liquidity, risk profile, and available market data.

Any discussion of whether a token could be “better” or “worse” positioned for 2026 is speculative. Investors should consider that early-stage tokens can be highly volatile and may carry liquidity and execution risks.

What the project says about Visa integration

Digitap has highlighted a collaboration with Visa as a key part of its payments narrative. Visa is a major global payments network, but the practical impact for end users depends on the specific product structure (such as cards, wallets, custodial arrangements, and compliance requirements) and the jurisdictions where it is available.

Project materials describe a goal of enabling crypto spending where Visa is accepted. Readers should treat this as a product claim unless it is supported by independently verifiable documentation and live availability.

Cardano and Digitap also have different starting points: Cardano is a long-running Layer-1 ecosystem, while Digitap is described as an early-stage finance application. Direct “winner vs. loser” comparisons can obscure these differences.

Market prices can react sharply to news and narratives, but there is no assurance that any product launch, partnership claim, or integration will translate into sustained adoption or token price appreciation.

How market participants compare early-stage and established assets

Some traders prefer early-stage projects because smaller market capitalizations can amplify price moves in either direction. That dynamic can increase both upside and downside risk, particularly during periods of low liquidity.

Digitap’s stated product scope includes wallet services, banking-style features, and crypto-to-fiat payment tooling. Whether and when these features reach users depends on execution and compliance.

For readers comparing assets for 2026, it is important to separate marketing claims from verifiable milestones, and to consider that “speed of execution” is not a guarantee of long-term success.

Token-related decisions should be made with an understanding of uncertainty, including potential changes in regulation, competition, and user behavior.

Digitap’s consumer-finance narrative in the current cycle

Crypto market themes have shifted over time (for example, Layer-1 competition, scaling, and AI-related narratives). Another area receiving attention is consumer-facing finance products that connect crypto and payments.

Digitap is positioning itself within that theme. As with other early-stage projects, claims about technology, partners, and adoption strategy should be evaluated against independently accessible sources.

Readers should also note that early-stage fundraising can involve marketing incentives and rapidly changing terms that may not be fully reflected in secondary-market conditions.

Project-reported token-sale figures

Digitap has reported surpassing $2.2 million in early funding as part of its token sale. The project has also published figures about token distribution and pricing during the sale.

According to the project, $TAP has been offered at $0.0361 during the sale period and more than 138 million $TAP tokens have been acquired. The project has also described the sale price as discounted relative to a stated launch value of $0.14; such comparisons are marketing context and do not indicate future market pricing.

Summary

ADA’s range-bound trading around $0.44 continues to shape sentiment among Cardano holders. Separately, Digitap is drawing attention by promoting a consumer-finance and payments narrative tied to $TAP and a token sale.

As 2026 approaches, themes such as payments and consumer-facing crypto tools may remain in focus, but outcomes for any individual token remain uncertain.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.