Holding long-established DeFi governance tokens while expecting renewed institutional momentum has become a point of debate as the market moves through early 2026. With digital asset prices consolidating and risk appetite moderating, capital allocation is gradually shifting toward projects emphasizing practical use cases and consumer-facing infrastructure.

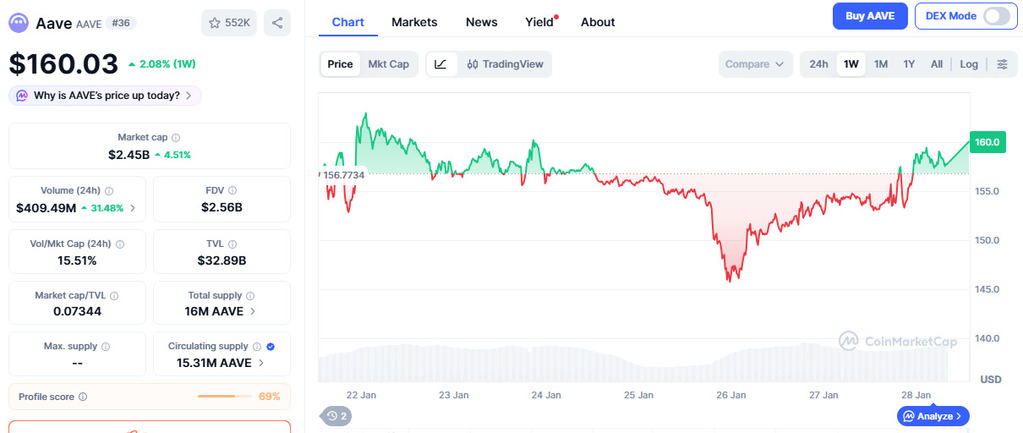

Within this environment, some market participants are reassessing exposure to mature DeFi protocols such as Aave (AAVE), which has recently traded near the $153 level. Attention has increasingly turned toward payment-oriented crypto platforms that aim to bridge blockchain functionality with everyday financial access. One project drawing discussion in this context is Digitap ($TAP), which positions itself as an omni-bank ecosystem combining blockchain rails with traditional payment features.

While Aave functions primarily as decentralized lending infrastructure, Digitap focuses on front-end financial tools intended for crypto-native users and those with limited access to traditional banking services. Its live application and ongoing presale structure have contributed to its growing visibility.

Aave’s Established Role Highlights the Limits of Mature DeFi Models

Aave has played a central role in decentralized lending for several years, supporting large volumes of on-chain borrowing and lending activity. However, in the current market cycle, some observers note a gap between protocol usage and token price performance.

As a mature asset, AAVE’s valuation is increasingly viewed through a stability lens rather than as a source of rapid expansion. Its utility remains closely tied to DeFi lending mechanics, primarily serving users who actively manage collateralized positions. While effective within its niche, this specialization limits direct relevance for broader consumer payment or spending use cases.

This contrast has encouraged comparison with platforms that aim to make digital assets usable beyond on-chain finance, particularly in everyday transactions.

Digitap Emphasizes Consumer-Facing Financial Access

Digitap presents itself as a crypto-enabled financial platform designed to simplify the interaction between digital assets and traditional payment systems. The project currently operates a live mobile application available on iOS and Android, offering users the ability to manage multi-chain crypto wallets alongside multi-currency fiat accounts.

The platform is designed to reduce reliance on multiple intermediaries by integrating crypto management, fiat balances, and card-based spending into a single interface. This functional approach has contributed to interest in its ongoing presale, as participation is tied to a platform that is already operational rather than conceptual.

By prioritizing usability and accessibility, Digitap aligns with a broader industry trend focused on lowering barriers between blockchain assets and real-world financial activity.

Solana Integration Expands Payment and Settlement Options

Digitap has confirmed integration with the Solana (SOL) network, enabling users to fund their accounts using SOL, USDC, and USDT directly from Solana wallets. This connection allows balances transferred from the Solana blockchain to be used within the Digitap ecosystem, including card-based spending.

The integration combines Solana’s transaction efficiency with Digitap’s payment infrastructure, offering an alternative route for moving digital assets into spendable formats. By avoiding extended settlement processes and multiple conversion steps, the platform aims to streamline how users access and use their funds.

This development reflects a broader effort across the sector to improve interoperability between blockchain networks and consumer payment tools.

Presale Participation Reflects Interest in Utility-Driven Models

Digitap’s presale structure has attracted attention primarily due to its focus on platform development and utility rather than speculative narratives. The project reports ongoing participation alongside continued application deployment and feature expansion.

Market observers note that interest in early-stage platforms often reflects expectations around adoption and execution rather than short-term price movements. In this context, Digitap’s emphasis on real-world payments, multi-network support, and live functionality differentiates it from purely infrastructure-based tokens.

Shifting Focus Toward Practical Crypto Applications

The broader market trend in 2026 suggests increasing scrutiny of how digital asset projects translate technology into practical use. While established DeFi protocols like Aave continue to play important roles within the ecosystem, newer platforms are being evaluated based on accessibility, consumer relevance, and operational readiness.

Digitap’s approach centers on unifying crypto and traditional finance within a single user experience. Whether this model gains sustained adoption will depend on execution, regulatory alignment, and user demand, but its positioning highlights the growing emphasis on real-world application across the sector.

Discover Digitap

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Giveaway: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.