TL;DR

- Bitcoin is nearing its previous record high with strong momentum supported by technical signals and increased network activity.

- Upcoming U.S. inflation reports, including CPI and PPI, are expected to influence market direction.

- Crypto investment products, especially Ether and Bitcoin ETPs, are experiencing notable inflows.

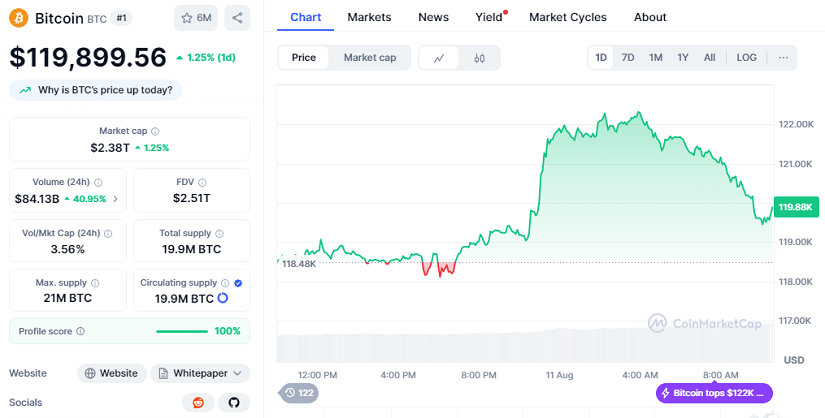

Bitcoin is currently trading at around $119,899.56 in the crypto market, showing a positive 24-hour performance of +1.25%. Its market capitalization stands at approximately $2.38 trillion, supported by a robust 24-hour trading volume of $84.13 billion, which has surged nearly 41%. This strong activity reflects renewed confidence from both retail and institutional investors, indicating growing adoption and interest.

After moving sideways near $115,000, Bitcoin’s momentum shifted as a golden cross appeared on the charts, signaling bullish trends. Analysts are now eyeing targets up to $130,000, based on historical patterns following Bitcoin halving events. On-chain data confirms growing interest, with new Bitcoin addresses reaching a one-year high, pointing to increased participation across different investor groups.

The critical factor this week is the release of U.S. inflation data, specifically the Consumer Price Index (CPI) and Producer Price Index (PPI). Economists forecast a moderate rise in inflation influenced by tariffs impacting consumer goods prices. These reports will heavily affect expectations around Federal Reserve interest rate policies.

Currently, markets estimate a 40% chance of two rate cuts by September, with a rising possibility of a 75 basis point cut following recent weaker labor statistics. Bitcoin’s growing appeal as a hedge against inflation adds to its potential strength amid these macroeconomic conditions.

Crypto Investment Products See Renewed Interest

Global cryptocurrency exchange-traded products (ETPs) recorded inflows of $572 million last week, recovering from previous slowdowns. Ether ETPs led the way with inflows close to $270 million, pushing year-to-date totals and assets under management to record levels.

A key catalyst for this inflow surge has been the U.S. government’s recent decision to allow digital assets in 401(k) retirement plans, boosting investor confidence. Although early-week outflows occurred due to weak payroll data, inflows surged later in the week, signaling renewed institutional interest and increased optimism about the future of digital assets.

With Bitcoin’s strong market presence and supportive macro trends, this week could determine whether it simply tests or finally surpasses its all-time high, setting the stage for a possible aggressive rally during the final months of the year.