TL;DR

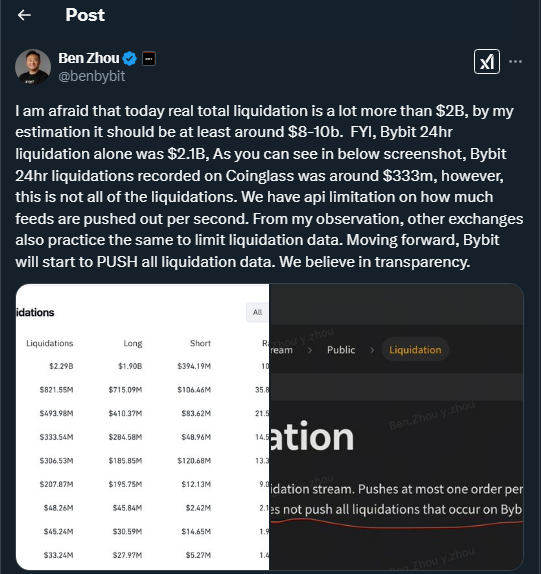

- Ben Zhou, CEO of Bybit, estimates that crypto liquidations are between $8 billion and $10 billion, much higher than the reported $2 billion.

- Bybit’s 24-hour liquidation figure was $333 million, but Zhou emphasizes this is only a small part of the total market.

- Zhou warns that crypto market volatility remains high, urging traders to be prepared for more price swings and liquidations.

Bybit’s CEO, Ben Zhou, shocked the market by pointing out that crypto liquidation figures are much higher than official reports suggest. While liquidation figures close to $2 billion have been mentioned, Zhou estimates the real number is between $8 billion and $10 billion, highlighting greater pressure and volatility in the market.

Zhou noted that the reported $2 billion figure does not adequately reflect the scale of the situation.

“What we are seeing is only a small part of what is actually happening in the market”,

he said. Bybit’s CEO emphasized that the $333 million liquidation figure over the past 24 hours, recorded by his platform, is just a fraction of global liquidations. This phenomenon reflects the stress traders face due to the volatility of popular cryptocurrencies like Bitcoin and Ethereum, which continue to experience unpredictable price swings that put investors at risk.

The recent increase in liquidations comes amid significant fluctuations in cryptocurrency prices. When prices drop suddenly, traders with long positions (those betting on rising prices) are forced to liquidate their assets to cover margins, triggering a cascade of liquidations across various exchanges. This process has exacerbated market instability, making it difficult for traders to predict short-term price movements, and leading to more selling pressure in the market.

Market Volatility and Trader Pressure

Crypto market volatility, which has been on the rise, has led both retail and institutional investors to actively participate in the market, intensifying the liquidation events. Zhou warned that this pressure is just beginning to manifest, and the liquidation figure could continue to rise, adding an element of uncertainty to an already volatile market. Increased retail trading, alongside institutional interest, has amplified the impact of these liquidation events.

Such liquidation events are not new in the crypto world, but the current magnitude is showing just how fragile the market has become in the face of abrupt price changes. While some platforms, like Bybit, have improved their risk management systems, traders need to stay vigilant.

Zhou also mentioned that although the current liquidations are concerning, there is an opportunity for traders to understand the importance of stronger risk management practices and to adapt to market fluctuations.