TL;DR

- A group of 160 wallets linked to the Edel Finance team acquired 30% of the EDEL supply, valued at $11 million, just before the public launch.

- The operation aimed to take advantage of low prices through multiple layers of wallets and bots, although the co-founder claims the tokens were locked in vesting contracts.

- Since its launch, EDEL has dropped 62% in a week, reflecting market concern over transparency in the initial distribution and potential internal practices.

Edel Finance, the decentralized lending protocol integrating traditional stocks into its on-chain platform, became embroiled in controversy following the launch of its EDEL token.

What Did Bubblemaps Find?

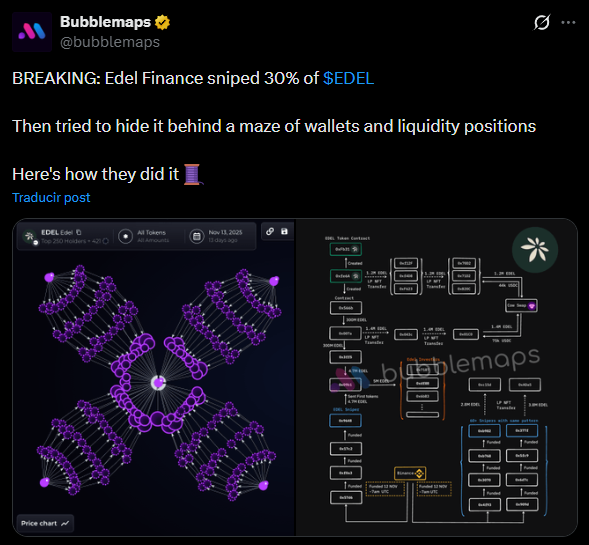

According to blockchain analytics platform Bubblemaps, a cluster of around 160 wallets linked to the team acquired 30% of the total token supply, valued at $11 million, just before public trading began. The operation was reportedly coordinated through multiple layers of wallets and Ethereum transfers, aiming to make the purchase go unnoticed by the general public.

In crypto terminology, this practice is called “sniping,” a method that uses bots to buy tokens immediately at launch at low initial prices. Each wallet reportedly received 50% of what it purchased, while the remainder was dispersed among roughly 100 secondary wallets, allegedly linked to the team through the token contract creation code, according to Bubblemaps.

Tokens Locked for 36 Months, According to Edel Finance

Edel Finance co-founder James Sherborne responded that the acquisition of 60% of the supply was part of the launch plan and that the tokens were locked in 36-month vesting contracts, with releases scheduled every six months. According to the project’s official tokenomics documents, only 12.7% of the total supply was directly allocated to the team, which Sherborne says rules out any irregularities. However, Bubblemaps characterized the defense as an attempt to justify the operation, comparing it to previous controversial cases of tokens with excessive insider supply that crashed after launch.

Since its November 12 launch, EDEL has a market capitalization of roughly $14.9 million and has lost 62% of its value over the past week. The decline reflects market concern over perceived manipulation and transparency in the initial distribution. Edel Finance is backed by former employees of State Street, JPMorgan, and Airbnb, and its protocol aims to bring stocks and real-world assets into the decentralized lending ecosystem, combining financial incentives with advanced blockchain technology.

The Edel Finance case highlights the importance of clarity in token allocation and effective communication with the community to prevent rumors of insider trading or unfair practices, especially during high-demand token launches