TL;DR

- Bitcoin falls in response to inflation data in the U.S., causing turmoil in financial markets.

- Consumer Price Index (CPI) data shows a 0.4% increase in March and a 3.5% increase over the last 12 months.

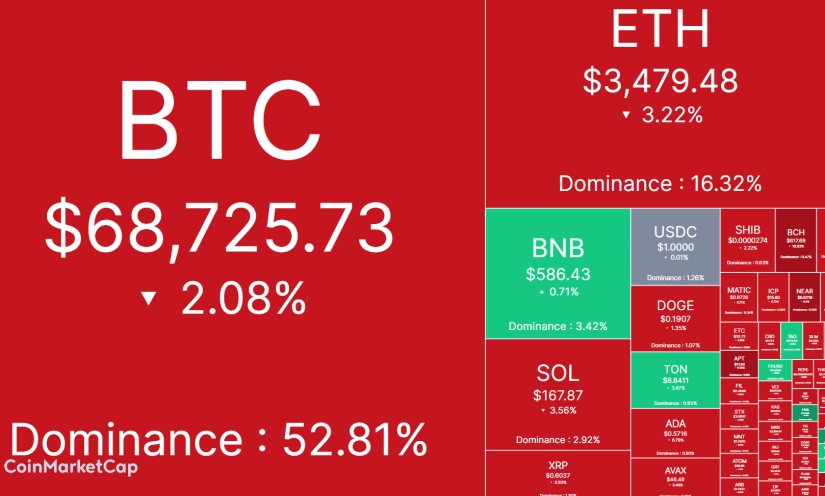

- The crypto market is slowly recovering from the blow, with Bitcoin trading above $68,000 and other altcoins like Ethereum, Solana, Avalanche, and Cardano experiencing similar fluctuations.

Bitcoin falls and creates turmoil in financial markets. All signs point to a triggering factor: inflation data in the United States. The numbers surprised economists, as inflation persists despite the Federal Reserve’s attempts to control it through aggressive monetary tightening measures.

The data reveals that the Consumer Price Index (CPI) increased by 0.4% in March, matching the increase recorded in February. Additionally, over the last 12 months, the index for all items has experienced a 3.5% increase before seasonal adjustments, surpassing previous estimates. These figures had a significant impact on financial markets, causing a drop in the price of Bitcoin by around $1,000 and the overall crypto market. Additionally, the dollar index (DXY) also experienced an increase.

The crypto market has slowly begun to recover from this blow. Bitcoin (BTC) is trading just above $68,000, losing 2.86% of its value in the last day and recovering 0.39% in the last hour. Ethereum (ETH) suffered a bit more. It dropped by 3.74% after a tough day and reached $3,455 after rising by 0.78% in the last hour.

Other altcoins follow the same trend. Solana (SOL) took a nosedive. After a 4.5% drop in 24 hours, it has barely started to recover, with a growth of 0.17% in the last hour, bringing it to $165.59. Avalanche (AVAX) lost 4.4% of its value, with a slight rebound of 0.4%, returning to the level of $46. Cardano (ADA) emerged as the loser of the day, experiencing a 7.4% drop and only rebounding by 0.6%, reaching $0.5688 per unit.

Crypto Market Crash

Investors seek alternative assets as a store of value against the devaluation of fiat currencies. Therefore, Bitcoin has been considered by many as a safe asset and a hedge against inflation, due to its limited supply and decentralized nature.

However, the plunge in BTC can also be attributed to uncertainty surrounding the Federal Reserve’s future decisions. Investors are awaiting whether the Fed will cut interest rates in response to inflation, which could affect BTC’s attractiveness as a safe asset.

U.S. inflation raises questions about the short- and long-term economic and financial outlook. On one hand, it suggests ongoing challenges for monetary policy and economic stability. On the other hand, it highlights the role of Bitcoin as an asset that can dynamically respond to changes in the economic environment.