TL;DR

- Bosera Asset Management and HashKey Group will launch the world’s first tokenized money market ETFs in April, with prior approval from Hong Kong’s financial regulator.

- The ETFs, denominated in HKD and USD, are part of “Project Ensemble,” a government initiative to explore real-world assets on the blockchain.

- This fusion of traditional funds and Web3 technology aims to provide greater transparency, liquidity, and operational efficiency for both traditional and DeFi investors.

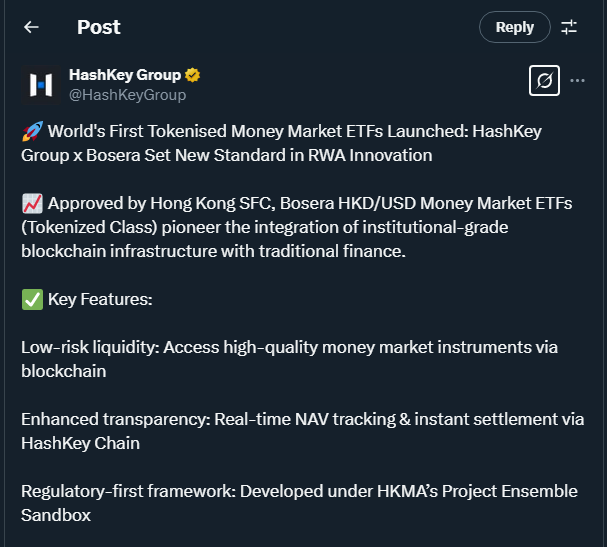

In an unprecedented step towards integrating traditional finance with the crypto ecosystem, Bosera Asset Management and HashKey Group have announced the launch of the world’s first tokenized money market ETFs, scheduled for April 2025. The initiative, already approved by the Hong Kong Securities and Futures Commission (SFC), marks a historic moment in merging the security of traditional financial instruments with the transformative power of blockchain technology.

These two groundbreaking financial products will be tokenized versions of the Bosera HKD Money Market ETF and the Bosera USD Money Market ETF, offering digital exposure to high-quality money market assets with daily liquidity and complete regulatory compliance. The offering is designed to attract both institutional investors seeking stability and DeFi enthusiasts exploring new ways to diversify their portfolios with safer options.

“Project Ensemble”: A Sandbox for Tokenized Real-World Assets

This launch is part of the ambitious “Project Ensemble”, spearheaded by the Hong Kong Monetary Authority (HKMA). Its goal is to foster a regulated environment where real-world assets can seamlessly exist on the blockchain with safety, efficiency, and broad accessibility. The partnership between public institutions and crypto leaders like HashKey places Hong Kong at the forefront of global financial innovation, setting a strong precedent for other jurisdictions to follow.

Dr. Xiao Feng, CEO of HashKey Group, emphasized that

“bringing ETFs on-chain is the first real step for traditional finance to embrace the potential of Web3.”

His view is widely echoed in the industry, where tokenization is not just seen as a technical evolution but as a structural transformation of global finance.

HashKey Exchange to Serve as Primary Distribution Channel

In addition to its tokenization role, HashKey will leverage its blockchain network, HashKey Chain, and NexaToken service to ensure secure and transparent digital asset management. HashKey Exchange will serve as the main distribution platform, providing a regulated, seamless, and efficient investment experience.

The adoption of tokenized ETFs not only enhances operational efficiency but also broadens investment opportunities for a global user base. At a time when markets are searching for stability and accessibility, this initiative offers exactly the kind of innovation the financial world needs: transparent, secure, and pro-crypto.