TL;DR

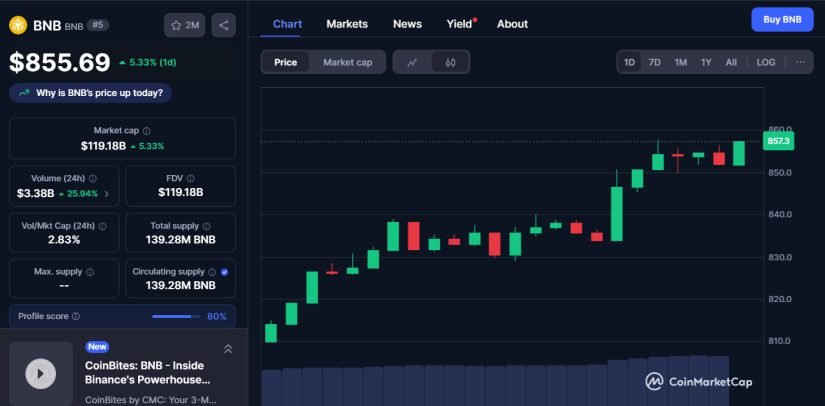

- BNB is trading at $855 after a 5.5% gain in the past 24 hours and is targeting $1,225, a level that would bring its market capitalization close to $150 billion.

- Spot demand is driving the rally, while low token inflows to exchanges are reducing selling pressure, with key support at $802 and resistance at $919.

- Binance continues its token burn program and holds 81% of the exchange token market.

BNB remains in an upward trend that, if sustained, could push its price to $1,225 and raise its market value to around $150 billion.

It is currently hovering around $855, up 5.5% in the last session, with a key resistance at $919. Breaking through that level could open the way to intermediate targets at $1,036 before reaching the most ambitious projections. The strength of the move is reflected in a relative strength index (RSI) of 64, signaling room for further gains without entering overbought territory.

The current momentum comes mainly from spot market demand, with limited BNB flows into exchanges. This reduces immediate selling pressure and sustains a favorable environment for buyers. Short-term support stands at $802; losing that level could cast doubt on the continuation of the rally, although buyers remain in control for now.

BNB Chain Accelerates Expansion in the RWA Market

In the tokenized asset sector, BNB Chain saw monthly growth of over 1,500%, reaching a total value of $42.9 million. While Ethereum still dominates with $7 billion, BNB Chain’s rapid expansion is drawing attention. The ecosystem also benefits from Binance’s regular token burns, which strengthen scarcity and can help support long-term prices.

Open interest in BNB futures climbed to $1.18 billion, signaling that traders are building positions to capitalize on a potential new bullish leg. The network is also recording growth in the number of applications, integrations, and transactions, all of which fuel demand for its native token.

BNB has solidified its position as the largest exchange token, holding 81% of the total value in this segment. This dominance leaves competitors such as LEO or BGB with a much smaller footprint. In terms of market capitalization, it has already surpassed Nike with more than $104 billion, ranking among the most valuable assets worldwide. Reaching $150 billion would place it alongside companies like Boeing, Citigroup, Nintendo, or Deutsche Telekom, a target that could be reached if the current market momentum continues