TL;DR

- Blockstream is launching three Bitcoin-backed investment funds after securing a multimillion-dollar capital injection, with an official launch set for April 1.

- Two funds will focus on Bitcoin-backed lending, allowing investors to access liquidity without selling their assets, while the third will offer hedging strategies for financial institutions.

- Institutional demand for Bitcoin-based financing is on the rise, with Blockstream and firms like Cantor Fitzgerald strengthening the financial infrastructure of the crypto ecosystem.

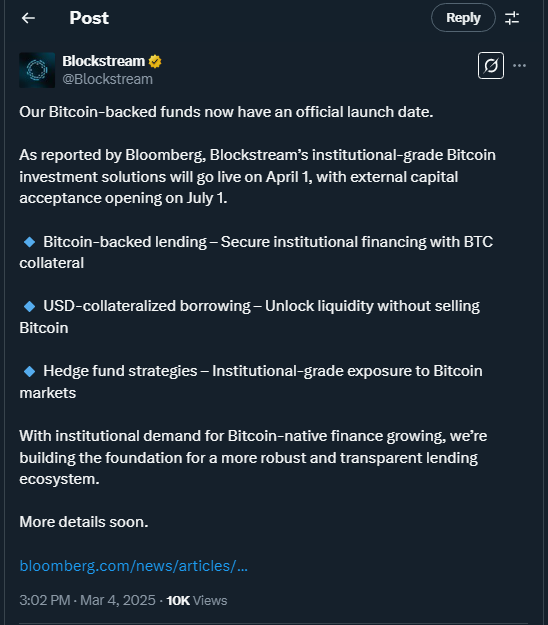

Digital asset infrastructure company Blockstream has announced the official launch of three new Bitcoin-based investment funds. This move comes after the company secured a multi-billion dollar investment, further solidifying its position as a leader in crypto financial solutions for institutional players. The company confirmed on X (formerly Twitter) that these products will be operational starting April 1 and will begin receiving external capital on July 1. Blockstream’s initiative is set to provide a secure and efficient pathway for institutional investors looking to gain exposure to Bitcoin without directly holding the asset.

The Growing Demand for Bitcoin-Backed Loans

The market for crypto-backed loans has gained traction as investors seek liquidity without parting with their digital assets. With Bitcoin establishing itself as the most secure and recognized asset in the crypto ecosystem, BTC-backed loans are experiencing significant growth. John Glover, CIO of Ledn, highlighted in an recent interview that demand for these products is increasing, especially following changes in the U.S. administration and the growing institutional acceptance of Bitcoin.

Blockstream emphasized that its goal is to establish a more robust and transparent financial infrastructure in response to the rising institutional interest in Bitcoin-native solutions. The company follows in the footsteps of Cantor Fitzgerald, which recently announced a collaboration with Tether to launch a Bitcoin-backed lending program.

Blockstream Expands into Asset Management

This is not Blockstream’s first step into investment management. In 2023, the company secured $210 million through a convertible note led by Fulgur Ventures, aimed at strengthening the development of its second-layer infrastructure. In January of this year, Blockstream formalized its asset management division with the introduction of two initial funds: the Blockstream Income Fund and the Alpha Fund, designed to provide secure and regulated financial products to institutional investors.

The launch of these new funds reaffirms confidence in Bitcoin’s future as a key financial asset. As institutional demand continues to grow, companies like Blockstream are paving the way for mass adoption, further solidifying the financial ecosystem built around cryptocurrencies. The firm’s ability to secure significant investment in a volatile market signals growing confidence among traditional finance players in Bitcoin’s long-term potential.