TL;DR

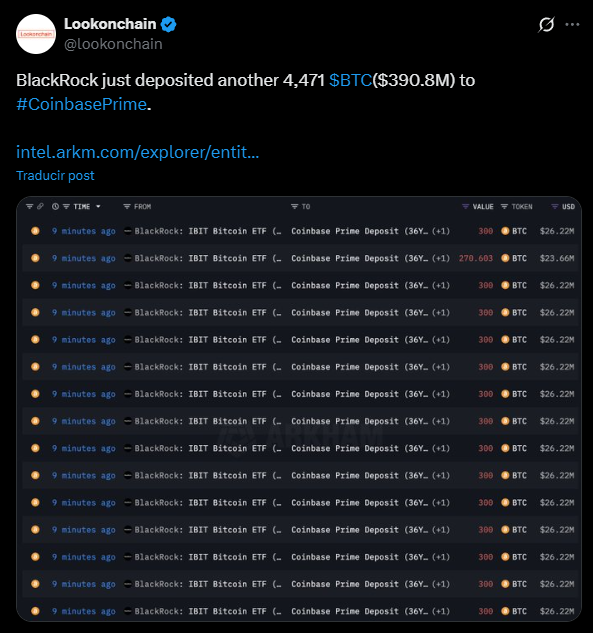

- BlackRock moved 4,471 BTC ($400M) to Coinbase Prime amid macro stress and just before the PPI.

- IBIT recorded over $2B in outflows, its worst month since launch, though most institutional holders remain.

- BlackRock’s wallet dropped 30% in value; analysts are split between structural liquidity pressure and a temporary squeeze.

BlackRock transferred 4,471 BTC, worth about $400 million, from its institutional wallet to Coinbase Prime on the eve of the U.S. Producer Price Index report.

The transaction took place during a month of heavy outflows from its Bitcoin ETF, IBIT, reigniting concerns about market liquidity and the impact of macroeconomic tensions on digital assets.

BlackRock (IBIT) Faces Its Worst Month

Arkham data shows that the wallet linked to BlackRock lost more than 30% of its value in recent weeks, falling from a peak of $117 billion to $78.4 billion. The transfer comes at a time of mounting pressure on Bitcoin, which dropped nearly 22% over the past month and is down 7% year-to-date. Analysts such as Crypto Rover warn that the move could intensify selling in an already weakened market.

Matthew Sigel of VanEck attributes Bitcoin’s fragility to macro factors, noting that the dynamic is “overwhelmingly a U.S. session phenomenon.” In his view, tightening liquidity and widening credit spreads collided with fears of excessive AI spending, creating a more fragile funding environment.

Experts Split Opinions

In contrast, Cathie Wood of ARK Invest argues that the current pressure is temporary. She claims the liquidity squeeze affecting both AI and crypto will reverse in the coming weeks. As evidence, she points to a 123% surge in Palantir’s U.S. commercial business, interpreting it as a sign that enterprise adoption is advancing despite macro headwinds.

BlackRock’s ETF is enduring its worst month since launch, with more than $2 billion in outflows. Still, interpretations differ. Walter Bloomberg describes the phenomenon as caution after months of steady inflows, while Eric Balchunas warns that headlines are stripping away context. He emphasizes that most institutional holders remain invested and that short interest has collapsed, suggesting that traders who typically short into strength have already closed positions during the downturn