TL;DR

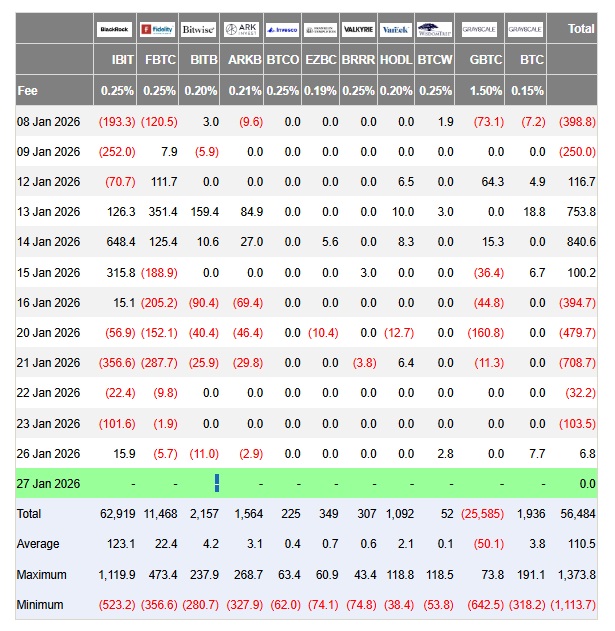

- BlackRock halted its massive Bitcoin sell-off after four consecutive days of outflows and recorded a positive inflow of $15.9 million in its IBIT ETF, helping the market close in the green.

- Other asset managers recorded smaller transactions: WisdomTree BTCW $2.8M, Grayscale BTC $7.7M, Fidelity FBTC -$5.7M, Bitwise BITB -$11M, and Ark Invest ARKB -$2.9M.

- Strategy purchased 2,932 BTC worth over $264 million in the last 48 hours; Bitcoin trades at $88,780 with a 1.2% increase, although volume fell 25% to $36.6 billion.

BlackRock halted its massive Bitcoin sell-off after four consecutive days of capital outflows. The firm reported a positive inflow of $15.9 million in its IBIT ETF, the highest recorded by any asset manager in the Bitcoin ETF market. This inflow helped the market close in the green after five consecutive days of net outflows.

Other managers recorded smaller amounts. WisdomTree BTCW and Grayscale BTC received $2.8 million and $7.7 million, respectively. Fidelity FBTC recorded $5.7 million in outflows, while Bitwise BITB and Ark Invest ARKB reported outflows of $11.0 million and $2.9 million. The remaining five managers registered no capital movements. BlackRock’s inflow offset the difference between inflows and outflows, leaving a net total of $6.8 million at the end of the trading day.

BlackRock Helps Market Close in the Green

BlackRock started 2026 by selling 1,134 BTC valued at $101.4 million, deposited on Binance. This operation generated selling pressure on the platform and the broader market. In the last 30 days, Bitcoin has risen just 0.09% and has not reclaimed a six-figure price. The most recent peak reached approximately $97,000 before falling again.

Bitcoin Recovers and Strategy Continues Buying

Currently, Bitcoin trades at $88,780, up 1.2% in the last 24 hours. Volume fell 25%, but remains above $36.6 billion. According to on-chain analyst Ali Martinez, total outflows in January reached $1.46 billion or 16,300 BTC from combined Bitcoin funds.

Meanwhile, the firm Strategy purchased 2,932 BTC worth over $264 million in the past 48 hours. This operation shows that accumulation strategies among certain institutional firms continue despite widespread selling pressure