TL;DR

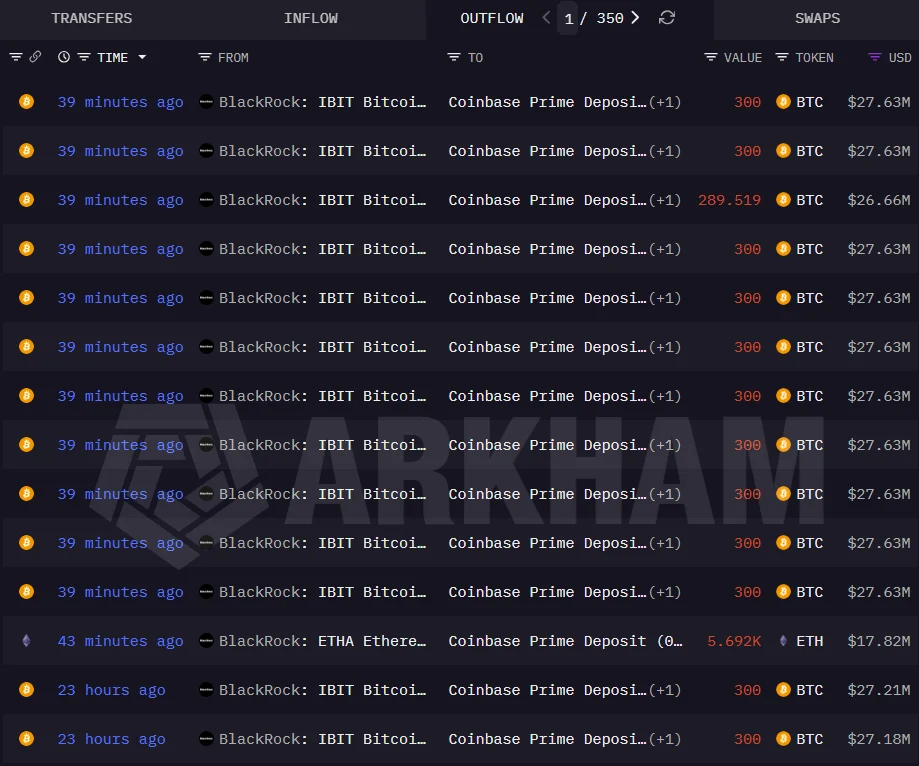

- BlackRock moved $320M in Bitcoin and Ethereum to Coinbase Prime.

- Its Bitcoin and Ethereum ETFs saw consecutive days of net outflows.

- Coinbase Prime serves as a key conduit for large institutional trades.

BlackRock moved $320 million in Bitcoin and Ethereum to Coinbase Prime, on-chain data from Arkham Intelligence reveals. The transfer included 3,290 Bitcoin ($303 million) and 5,692 Ethereum ($18 million). This activity coincides with persistent outflows from its crypto ETFs, underscoring institutional wariness amid erratic market conditions. Large transfers like this rarely signal immediate sales, but their timing amplifies scrutiny during prolonged redemption cycles.

BlackRock’s spot Bitcoin ETF, IBIT, saw $71 million in net outflows yesterday, marking its fourth consecutive day of withdrawals. Its Ethereum ETF bled $80 million over the same period. These exits compound pressure on U.S.-listed crypto ETFs, which collectively lost $1.2 billion in net assets over the past three weeks per Farside Investors. Institutional investors remain hesitant to lock in long-term exposure despite regulated product availability.

Operational shifts amid volatile markets

Price swings and macroeconomic uncertainty—driven by central bank policies and geopolitical tensions—shape institutional strategies. Asset managers like BlackRock prioritize portfolio rebalancing over fresh capital deployment.

Transfers to Coinbase Prime, a service for institutional clients, likely support liquidity management or risk-hedging maneuvers rather than liquidation. The platform’s infrastructure allows large trades without disrupting retail markets, offering flexibility during uncertain phases.

BlackRock’s entry into ETFs legitimized digital assets for conservative investors, yet its current retreat highlights fragile institutional demand. Crypto ETFs require steady inflows to maintain liquidity, but short-term returns fail to convince pension funds or insurers. BlackRock’s moves reflect tactical caution, not abandonment: it retains dominant positions in both Bitcoin and Ethereum ETFs while optimizing operational workflows.

Coinbase Prime gains strategic importance as institutions seek stability. Its tools for executing complex trades position it as a critical intermediary during market turbulence. Meanwhile, BlackRock’s $9 trillion asset base ensures its actions ripple across crypto markets. Every transfer becomes a signal—interpreted as either preparation for volatility or loss of confidence.

The industry enters 2026 under dual pressures: regulatory tightening and demands for tangible returns. Institutions no longer chase hype; they prioritize capital preservation. BlackRock’s adjustments exemplify this shift. Its ETF outflows and wallet movements reveal a preference for measured steps over bold bets. Markets react nervously not because of single transactions, but due to the broader trend of institutional hesitation.

Crypto’s maturity hinges on reconciling innovation with realism

ETFs proved adoption is possible, but sustaining it requires more than regulatory approval. It demands consistent performance and risk management frameworks that align with traditional finance standards.

For now, BlackRock’s moves serve as a barometer. They show institutions testing the waters—not diving in. The next quarter will clarify whether this caution is temporary or a lasting recalibration. Until then, traders watch every wallet movement, decoding signals in a market that rewards patience but punishes complacency.