TL;DR

- Bitwise projects that Ethereum ETFs could attract up to $10 billion in the second half of 2025, driven by growing institutional interest.

- In June, inflows to these ETFs exceeded $1.17 billion, and in the last 24 hours, $40.7 million in new investments were recorded.

- Companies like Bit Digital and Robinhood are strengthening the ETH ecosystem with million-dollar investments and the launch of new solutions.

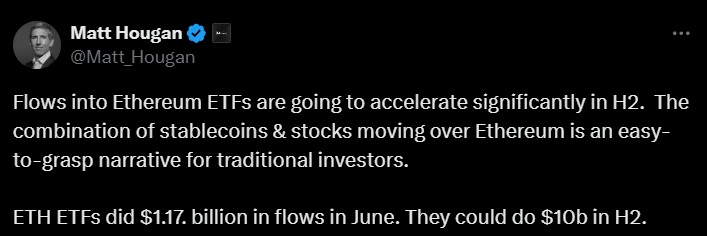

Bitwise forecasts strong growth for Ethereum in the second half of 2025, anticipating that its exchange-traded funds (ETFs) could capture up to $10 billion.

The firm’s forecast is based on activity observed in June, when Ethereum ETFs recorded inflows surpassing $1.17 billion. Bitwise’s Chief Investment Officer, Matt Hougan, expects this trend to accelerate, fueled by increasing interest from institutions and large firms.

The rising demand for Ethereum ETFs stems from a combination of factors. On one hand, the regulated market offers traditional investors a familiar and secure way to enter the crypto space. On the other, ETH has established itself as a platform for real-world assets and stablecoins, building a value proposition that appeals to both professionals and conventional investors. These factors have helped ETH expand its user base and gain trust in formal financial sectors.

The Market Shifted Its View on Ethereum

Since Ethereum ETFs started trading in the U.S. in July 2024, adoption was initially slow. However, growing institutional interest has changed this dynamic, increasing liquidity and improving market perception. In the past 24 hours, $40.7 million in inflows were reported to the ETFs, a clear sign of healthy activity.

At the same time, well-known companies are entering the ecosystem built around Ethereum. Nasdaq-listed Bit Digital raised $163 million to strengthen its ETH treasury. Meanwhile, Robinhood developed the “Robinhood Chain,” a layer-two solution based on Arbitrum aimed at optimizing the management of real-world assets on ETH. This initiative rests on solid legal and regulatory foundations and aims to facilitate adoption in both public and private markets.

Institutional interest and the development of innovative products have led to a shift in how Ethereum is perceived. It is now moving toward a more mature phase, consolidating itself as an attractive asset for various investor profiles