TL;DR

- Bitcoin has gained increasing interest among investors and analysts.

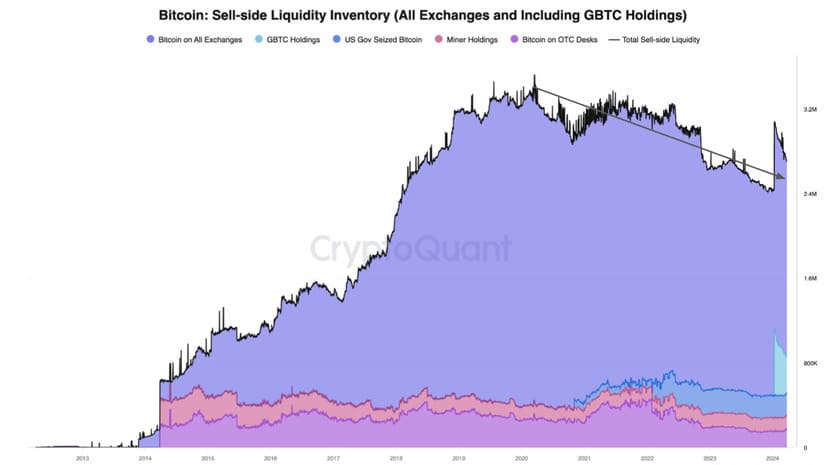

- The “sell-side liquidity crisis” indicates a decrease in the supply of BTC available for sale while demand increases.

- The introduction of ETFs in the United States has significantly contributed to the exponential growth in BTC demand, exacerbating the liquidity crisis.

Amid market fluctuations, Bitcoin has emerged as an asset of growing interest for both investors and analysts. Recently, a report by CryptoQuant has highlighted a notable trend: a “sell-side liquidity crisis” affecting the BTC market.

This situation, described in the report as a scenario where the supply of Bitcoin available for sale is diminishing while demand continues to rise, has led to several significant implications for the crypto market as a whole.

One of the main drivers of this sell-side liquidity crisis has been the introduction of Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs have opened doors for a wide range of institutional and retail investors to access the BTC market, resulting in exponential growth in demand for this digital asset.

As a result of this increased demand, the supply of Bitcoin available in the markets has begun to gradually decrease. According to the report, BTC liquidity has reached its lowest level in terms of months of demand, suggesting that the current supply may not be sufficient to meet the growing demand in the near future.

Early Bitcoin Investors Mobilize Their Holdings

A particularly notable aspect of this crisis is the unusual movement of Bitcoin observed recently. For the first time since 2010, significant movements of Bitcoin have been recorded, indicating that early BTC hodlers are beginning to mobilize their assets in response to increased demand and the perception of future scarcity.

Both investors and market analysts are closely monitoring the behavior of ETFs. Despite some net outflows of funds in previous weeks, significant inflows have recently been observed, suggesting that the trend may be reversing towards greater demand for Bitcoin through these investment vehicles.

As demand for BTC continues to rise and available supply decreases, we are likely to see increased volatility and investment opportunities in the near future, especially in light of the upcoming halving scheduled for April.