Bitcoin (BTC) prices are firm when writing on April 28, rejecting attempts for lower lows. Technically, there could be bearish pressure, but the expansion towards $30k on April 26 and the buildup of buyers yesterday support the current bullish preview.

As such, based on the current development and the realization that Bitcoin (BTC) prices are above the immediate resistance level, now support, at $28.3k, acording to CoinMarketCap, is bullish.

Provided prices are above this mark, optimistic and aggressive traders may look to double down with targets at $31k.

However, conservative traders may wait for better entries above $31k or below recent primary support at $27k.

Volatility and Whales

The expansion to spot rates is amid news on April 26 that redirected attention to Bitcoin (BTC).

In what has been established as a “false alert” and error on its systems, Arkham Intelligence, a blockchain analytics platform, said there had been no movement of coins from Bitcoin (BTC) wallets controlled by Mt. Gox managers or that under the United States government.

Mt. Gox managers and the United States government hold billions worth of Bitcoin (BTC). Even so, the civil rehabilitation plan for Mt. Gox victims will distribute payments to victims by September 2023. Before then, traders are closely monitoring these wallets.

Any transfer from these whale wallets to external wallets is often associated with liquidation.

This explained why BTC prices, after dumping $2k in minutes, bounced back strongly to a trend above $29k for the better part of April 27.

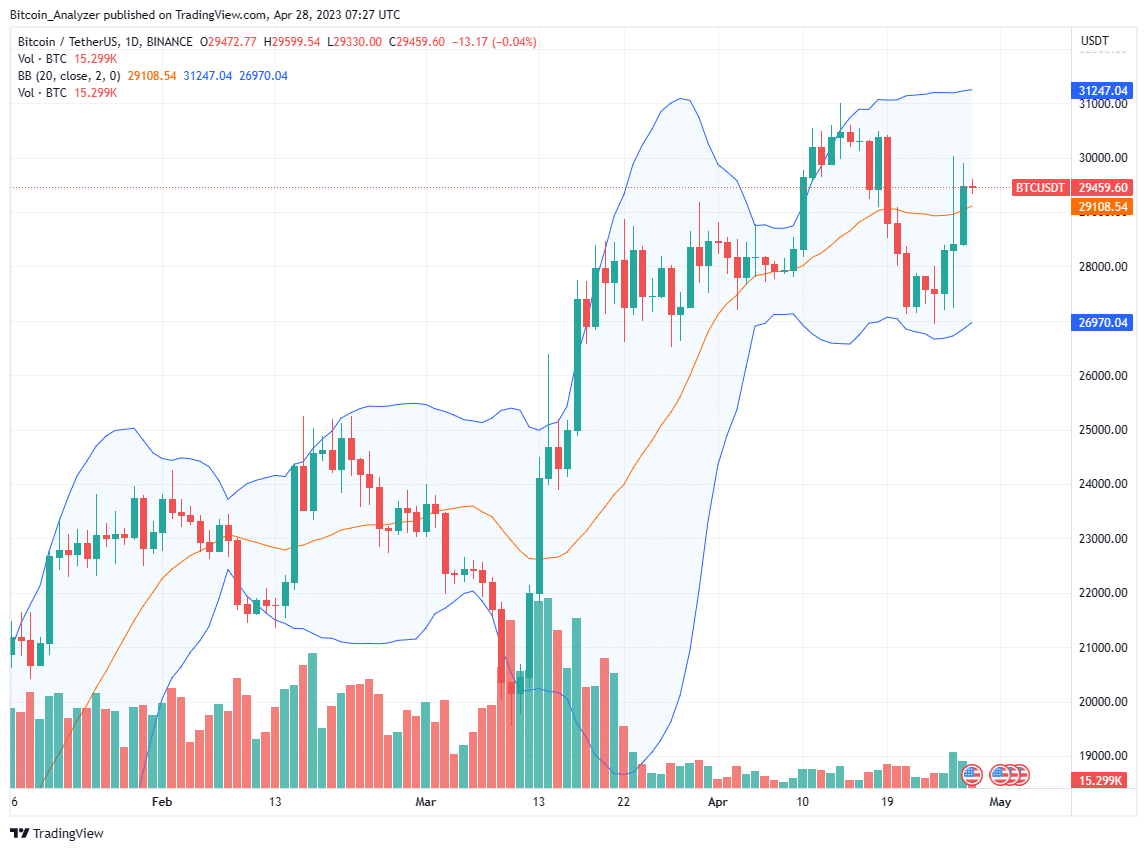

Bitcoin (BTC) Price Analysis

Buyers are firm, up roughly 10% from April lows, building on the gains of April 26.

The rejection of prices on April 26 and the confirmation of buyers yesterday points to general market confidence, a net positive for the coin.

Note that Bitcoin (BTC) prices are also above $28.3k marking April 21 highs.

At this pace, aggressive traders can look for dips above $28.3k targeting $31k.

This bullish preview is also supported by the recent spike in the price above $28.3k with expanding volumes, a positive from an effort-versus-result perspective.

Meanwhile, conservative, risk-on traders can wait for a clear trend definition above $31k or below $27k, should bears take charge.

A snap-to-trend above $31k may lift BTC back to $35k.

Conversely, sharp losses below $27k may trigger a sell-off, forcing BTC back to $25k or February highs in a retest.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Bitcoin News.