TL;DR

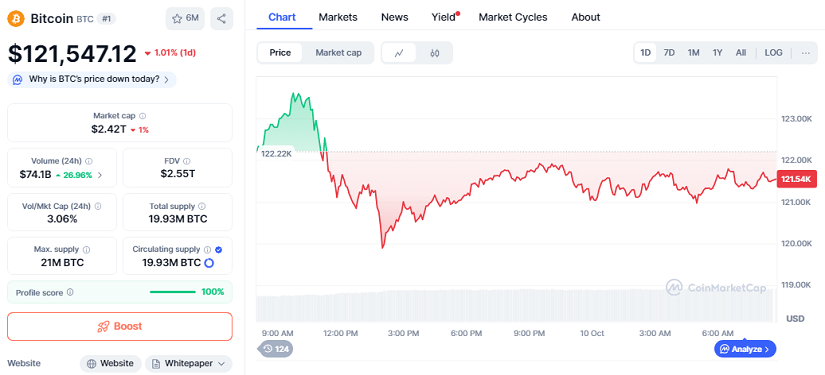

- Bitcoin trades near all-time highs at $121,547.12, with a 24-hour decline of -1.01%.

- Its market capitalization stands at $2.42 trillion, while daily trading volume rises 27% to $74.1 million.

- The Mayer Multiple at 1.16 signals that Bitcoin still has significant room to grow toward $180,000 without entering overbought territory. Analysts see this cycle as potentially more sustainable than previous ones.

Bitcoin continues to hover near record highs, showing resilience despite short-term fluctuations. The Mayer Multiple, comparing Bitcoin’s price to its 200-week moving average, currently reads 1.16, suggesting the market is far from overextended. This indicates potential for further upward movement, with analysts projecting that BTC could climb toward $180,000 if momentum persists. The broader market has also seen renewed interest from institutional investors, with trading volumes increasing steadily, indicating growing confidence in Bitcoin’s long-term potential.

Analyst Insights On Bitcoin’s Remaining Potential

Crypto quant analyst Frank A. Fetter highlighted that the Mayer Multiple remains “ice cold” compared to historical peaks, signaling a healthier bull cycle. Previous cycles reached above 2.4, reflecting overheated markets, while this cycle’s highest reading was 1.84 in March 2024 when Bitcoin traded near $72,000. This muted reading implies room for sustained growth without speculative excess.

Axel Adler Jr., a crypto researcher, described readings near 1.1 as a “fuel reserve” for new upward impulses. Traders remain divided on timing, with some predicting temporary retracements to $114,000, while others expect steady gains over the coming months. Despite minor volatility, the Mayer Multiple supports the view that Bitcoin’s long-term path remains bullish. Market sentiment across exchanges suggests that investor patience may favor a gradual accumulation phase rather than sudden spikes, further supporting the potential for continued upside.

Bitcoin Faces Critical 100-Day Window For Price Action

Trader Tony “The Bull” Severino warns that the next 100 days could determine whether Bitcoin enters a rapid rally or stabilizes in its current bull cycle. Observing weekly Bollinger Bands, Severino noted the compression could precede sharp price movements in either direction. A recent touch of $126,000 failed to break the upper band, hinting at possible short-term dips.

Currently, BTC trades at $121,547.12 with a 24-hour loss of -1.01%, a market cap of $2.42 trillion, and 24-hour volume up 27% to $74.1 million. Analysts remain cautiously optimistic, noting that longer cycles and favorable on-chain indicators suggest that Bitcoin could reach $180,000 if upward momentum continues. The coming months may prove decisive for whether this cycle accelerates or maintains steady growth, with many expecting continued volatility followed by potential breakthroughs as market confidence strengthens.