TL;DR

- Bitcoin is hovering around $97,000 and threatens to liquidate over $3 billion in short positions if it surpasses $100,000.

- Long positions also face risk if it drops below $93,000.

- Critical liquidation levels are concentrated at $85,000–$87,000 for longs and $115,000–$130,000 for shorts, which could further accelerate price movements.

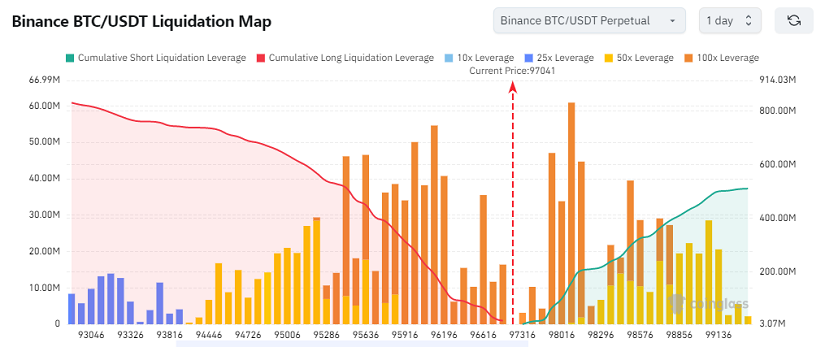

The Bitcoin market is currently experiencing a moment of high tension, with the price trading near $97,300 and testing key resistance levels. According to data from CoinGlass, if BTC rises just 3.14% to hit $100,000, roughly $3.36 billion in short positions could be liquidated. This scenario puts bearish traders in a tough spot, as a breakout above that level wouldn’t just wipe out those shorts but could also trigger a wave of impulsive buying and speculative enthusiasm across the entire market.

Key Liquidation Levels In The Crypto Market

The cumulative liquidation map reveals particularly vulnerable zones. On the long side, if the price falls below $95,000, especially approaching $93,000, we could see liquidations totaling around $60 million. On the flip side, if BTC surpasses the $98,000–$99,000 range, the market may experience a massive short squeeze, reaching up to $400 million in accumulated liquidations, which could act as fuel to break past the psychological $100,000 barrier.

Additionally, recent data from the Binance BTC/USDT pair shows that highly leveraged contracts (50x and 100x) dominate the $95,000–$98,000 zone, increasing the likelihood of sharp moves in both directions. Analysts point out that even a minor bullish headline could be enough to push the price higher. This context has caught the attention of institutional investors, who see the current volatility as an opportunity to position themselves ahead of a possible new all-time high, which could happen very soon.

Bitcoin Prepares For The Next Big Leap

From a pro-crypto perspective, this moment represents a critical test for Bitcoin. Far from being just a speculative game, the push toward $100,000 reinforces the narrative of BTC as a digital store of value. Bullish traders are betting that if the price breaks through $103,000–$115,000, massive short liquidations could catapult the asset to $130,000. Moreover, with a market full of high leverage (25x, 50x, 100x), even small price movements can trigger domino effects.

Meanwhile, institutional adoption and ETF inflows continue to provide an optimistic backdrop for the coming months.