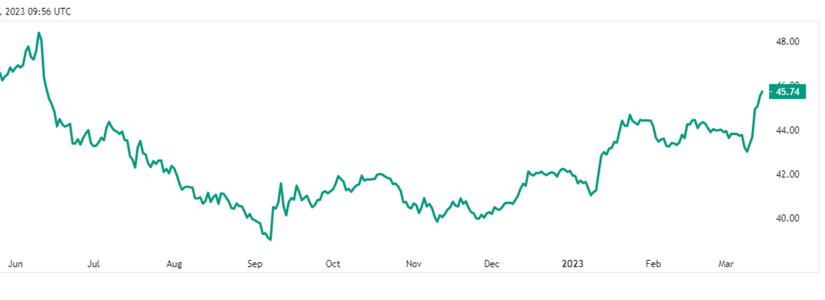

Bitcoin dominance, expressed as a percentage of the crypto market’s total capitalization maintained by BTC, reached its highest level in nine months late Wednesday, exceeding 45.5%, per a recent chart from TradingView.

Bitcoin’s surge in dominance comes after the coin reached its highest level since last June, moving toward $26,000 earlier this week.

This was an impressive growth from last week’s drop to new two-month lows below the $20,000 mark. The decline last week was brought on by broader risk-off flows following a string of failed United States Banks, including Silicon Valley and Silvergate, which are the leading crypto/tech-friendly banks.

Meanwhile, experts believe that this week’s rebound was spurred by a mix of positive reasons, including a proactive reaction by US authorities to backstop deposits, the announcement of a new bank liquidity program–which enabled USDC to return to its $1 peg–and anticipation that the prospect of a financial crisis would dissuade the Fed from participating in significant further rate rises.

Is Bull Run Coming?

BTC dominance, sometimes known as BTCD, is a metric for comparing Bitcoin’s market cap to the market cap of the whole crypto market.

According to TradingView, coin dominance measures a currency’s market cap in relation to the total market cap of all cryptocurrencies.

“It’s a great way to see how big a coin is relative to the whole crypto market — the value of everything is in comparison,” TradingView noted. “It’s calculated by dividing a coin market cap by the overall market cap of the top 125 coins and then multiplying it by 100.”

Traders have discovered methods to utilize this metric to forecast bull markets, altcoin seasons, and bitcoin rallies far in advance.

For instance, a rapid decline in Bitcoin’s market dominance even as Bitcoin’s price is rising might indicate that the altcoin season is already well underway. On the other side, a rise in BTCD, like it recently did, might probably lead to a price spike.

Nevertheless, while the surge in dominance may indicate a bull run, traders still predict some correction in the BTC price before the main positive moves resume.