TL;DR

- Bitcoin’s price has fluctuated between $91,000 and $102,000 for over three months, but it dropped sharply due to the Bybit hack and a mass sell-off of S&P 500 options.

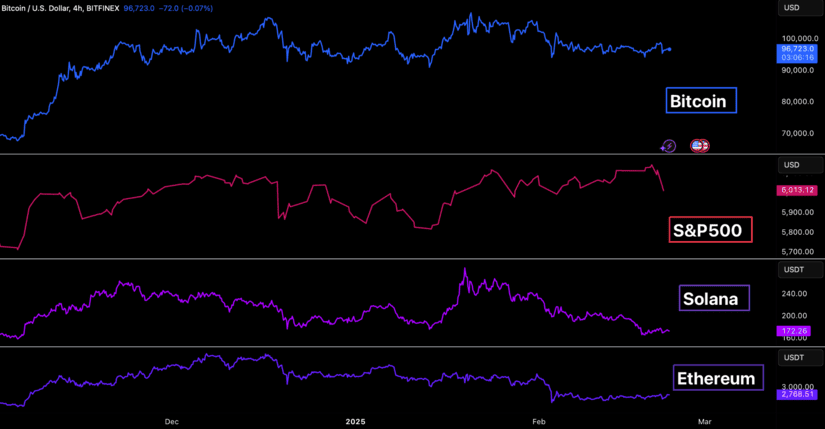

- The crypto market has gone through a broad correction, with huge losses in February, exacerbated by growing economic uncertainty and BTC’s increasing correlation with traditional markets.

- Institutional demand for BTC has significantly decreased, with negative fund flows in Bitcoin ETFs, reflecting a market contraction.

Over the past week, Bitcoin’s market has remained stable, fluctuating between $91,000 and $102,000, without experiencing sharp movements.

This consolidation period has lasted for over three months, reflecting a lack of momentum in the market. However, on February 21, volatility surged abruptly due to two factors: the Bybit hack and a massive S&P 500 options sell-off, causing a 4.7% drop in Bitcoin’s price, although it regained some ground over the weekend.

Markets have gone moribund according to Bitfinex Alpha 👀

— Bitfinex (@bitfinex) February 24, 2025

Bitcoin has been range-bound between $91K and $102K for over 90 days.

Volatility surged on Feb 21st after the @Bybit_Official hack and an S&P 500 options expiry sell-off, causing a 4.7% drop to ~$95K before it recovered 🚨 pic.twitter.com/Pvv47nKWnu

Overall, the crypto market has experienced a correction following the rallies of late 2024. Bitcoin, Ethereum, and Solana have all suffered losses in February, with declines of 5.9%, 16.9%, and 33.1%, respectively. Additionally, memecoins, which had also surged in December, have experienced huge drops, up to 37.4%.

The decline in the value of digital assets is further aggravated by growing global economic uncertainty and Bitcoin’s increasing correlation with traditional markets. The stagnation of the S&P 500 index below 6,000 points has cooled risk appetite, reducing speculative participation in high-risk assets.

Declining Institutional Demand for Bitcoin

Another significant factor is the decline in institutional demand. The flow of funds into Bitcoin ETFs, which peaked at 18,000 BTC per day in November 2024, has turned negative, with $360 million withdrawn in February alone. This reduction in institutional participation, coupled with a decrease in leveraged trading activity, indicates a general contraction in the market.

The Shadow of Economic Uncertainty

On the other hand, the economic situation in the United States is also putting pressure on financial markets. The drop in consumer confidence, combined with rising inflation expectations, is affecting economic growth prospects. Uncertainty about the Federal Reserve’s policies and the potential impact of the tariffs proposed by the White House could also have a negative effect on the crypto market.

The crypto market continues to show an uncertain future, and the performance of Bitcoin and other cryptocurrencies will depend on both internal and external factors, including economic developments and regulatory policies