TL;DR

- Pierre Rochard formally asked the Federal Reserve to add Bitcoin to its 2026 bank stress tests.

- He argues Bitcoin’s extreme volatility and unique price behavior require separate risk modeling.

- The request follows regulatory confusion over the U.S. government’s handling of seized Bitcoin.

Pierre Rochard, chief executive of The Bitcoin Bond Company, formally asked the Federal Reserve to include Bitcoin as an independent variable in the 2026 supervisory stress tests. The request, submitted on January 20, argues that Bitcoin’s price behavior and expanding presence inside institutional balance sheets require separate treatment from other digital assets in banking risk models.

Rochard challenges the current approach that groups Bitcoin with a broader crypto category. His letter states that such aggregation masks risk characteristics that differ sharply from equities, commodities, or alternative assets.

It is in the United States national interest to become the Bitcoin Superpower.

To that end, the Federal Reserve should begin integrating bitcoin into its stress tests and scenarios.

I've sent in a comment letter explaining what I believe to be reasonable path forward. (🧵1/3) pic.twitter.com/rDILZMpFv5

— Pierre Rochard (@BitcoinPierre) January 20, 2026

The submission relies on quantitative analysis covering data from 2015 through early 2026 and frames Bitcoin as a distinct exposure with unique implications for capital adequacy, liquidity planning, and counterparty risk.

Questions arose over compliance with Executive Order 14233, which directs confiscated Bitcoin toward a Strategic Bitcoin Reserve instead of liquidation. The Department of Justice later clarified, through White House crypto advisor Patrick Witt, that 57.5 BTC remained unsold, easing speculation after analysts identified a transfer to a Coinbase Prime address.

Volatility metrics drive the proposal

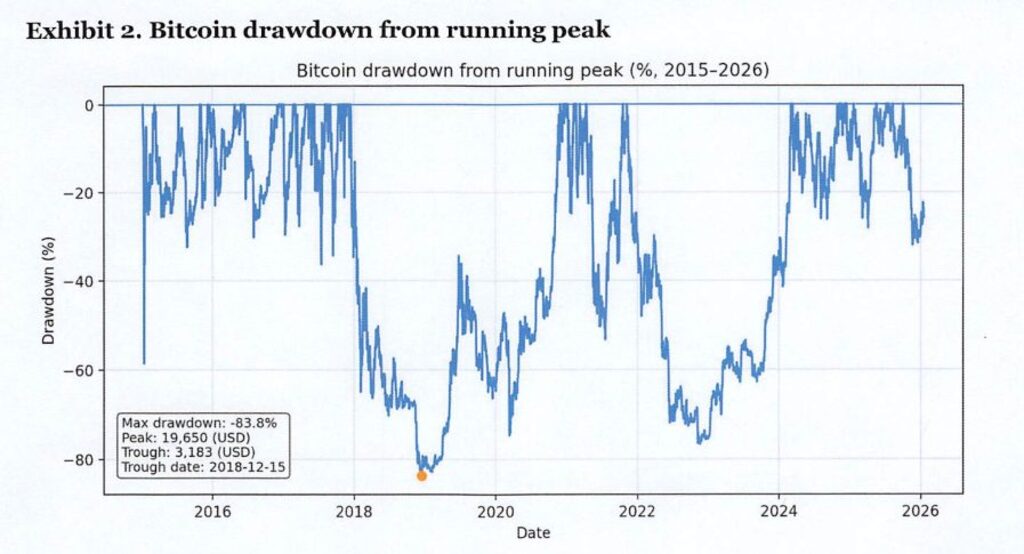

Rochard’s analysis highlights 73.3% annualized realized volatility for Bitcoin across the study period. The S&P 500 posted 18.1% over the same span. Bitcoin also recorded a maximum drawdown of 83.8%, with daily return extremes stretching from -10.0% at the 1st percentile to 10.7% at the 99th percentile. Such figures exceed the statistical range used in standard supervisory models.

The letter argues that Bitcoin displays non-linear risk behavior, marked by deep drawdowns and prolonged volatility clusters. Rochard explains that valuation models, margin frameworks, and liquidity assumptions respond differently under such conditions. Proxying Bitcoin exposure through equity or sentiment variables, he writes, produces inconsistent results across market regimes.

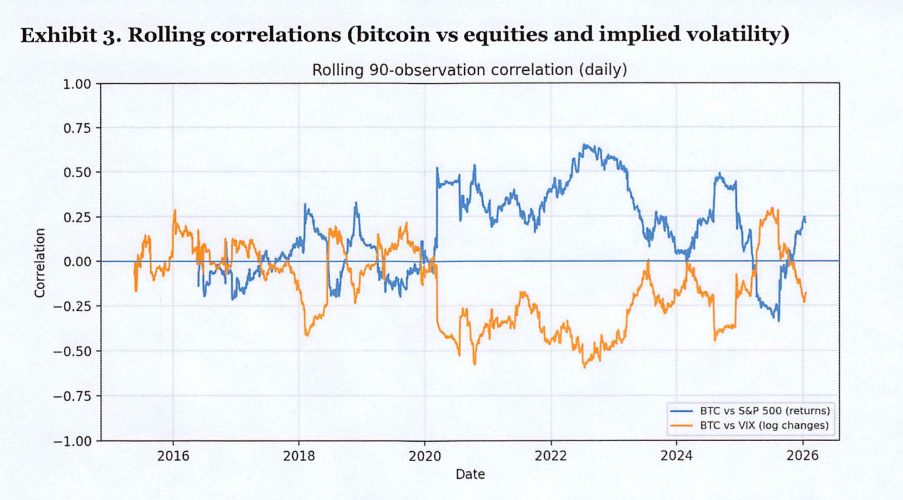

Rolling correlation studies included in the submission reinforce the point. Bitcoin’s relationship with the S&P 500 shifts between negative and strongly positive across 90-day windows. Rochard warns that a single beta assumption misprices exposure during regime changes, leading to underestimation or overestimation of risk depending on timing.

To address model divergence, Rochard proposes that the Federal Reserve publish quarterly Bitcoin price paths for baseline, adverse, and severely adverse scenarios. Optional daily paths could support global market shock exercises. He outlines three calibration options: historical feature matching based on drawdowns and volatility percentiles, regime-switching time series with separate bull and bear parameters, and jump-diffusion models designed to capture tail events.

Bitcoin recently fell near $88,000, while liquidations exceeded $1 billion in a single day. Gold traded above $4,800 per ounce, reviving debate over reserve assets. Galaxy chief executive Mike Novogratz commented that gold pricing signals pressure on dollar dominance, while Bitcoin continues to face selling pressure.

The Federal Reserve accepts public feedback on the 2026 stress test scenarios until February 21. Senator Cynthia Lummis has also reentered the debate, renewing proposals for government Bitcoin accumulation through budget-neutral methods.