TL;DR

- A Bitcoin whale that resurfaced after seven years sold 6,000 BTC in two days and now holds over 886,000 ETH valued at nearly $4 billion.

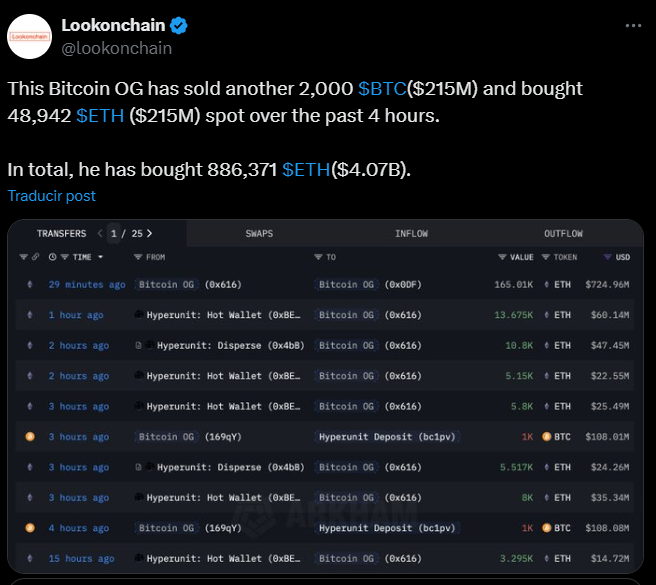

- On Sunday, it swapped 4,000 BTC for 96,859 ETH in 12 hours, and on Monday sold another 2,000 BTC to acquire 48,942 ETH in just four hours.

- ETFs reflect the same trend: in August, Bitcoin funds saw $751 million in outflows while Ethereum funds recorded $3.87 billion in inflows.

An old Bitcoin holder who returned to activity in August sped up fund rotation into Ethereum over the past weekend. The wallet, which originally held more than $5 billion in BTC, sold thousands of coins to strengthen its ETH position and now controls close to $4 billion in the asset.

On Monday, it sold 2,000 Bitcoin, worth about $215 million, and used the proceeds to buy nearly 49,000 Ethereum in just four hours. The previous day, it had executed an even larger trade, selling 4,000 BTC to obtain roughly 97,000 ETH in a twelve-hour window. Combined, these purchases have lifted its total ETH holdings to more than 886,000, according to data from on-chain analytics firms tracking its transactions.

Whales Start to Wake Up

Throughout August, the same wallet had already carried out large-scale trades after lying dormant for seven years. Earlier reports indicate that in a single week it bought over $2.5 billion worth of Ethereum, abruptly reshaping the composition of its reserves.

This pattern aligns with flows seen in cryptocurrency exchange-traded funds. In August, Bitcoin ETFs ended the month with net withdrawals of $751 million, while Ethereum ETFs registered $3.87 billion in net inflows—a stark contrast that underscores growing institutional focus on ETH.

Shifting Perception of Bitcoin and Ethereum

Analysts note that whale trades often set short-term market trends, as many traders quickly follow their moves. In July, a similar event occurred when another wallet moved 80,000 Bitcoin after fifteen years of inactivity, sparking immediate speculation about a potential large-scale sale.

Beyond the direct price impact, the scale of these transfers signals a shift in how the market values the two leading cryptocurrencies. It also highlights Ethereum’s rising appeal, fueled by institutional activity and demand for its network in decentralized financial applications