Bitcoin’s trading range near $90,000 has become a notable moment for the market. Prices have remained elevated, but sentiment appears mixed. Some traders are looking beyond short-term price moves and toward projects that emphasize product delivery and clear use cases.

Digitap ($TAP) is being marketed as a banking-focused crypto project with an app it says is already available, plus a token model linked to platform activity and revenue. The project is conducting a token sale, though details and outcomes remain project-reported and subject to change.

Bitcoin Stays Near $90,000 but Shows Limited Momentum

Bitcoin has attempted to move above nearby resistance levels, but recent advances have been met with selling pressure. One move above $94,000 was followed by a pullback toward $90,000, reflecting a market that is still searching for direction.

Source: TradingView/BTC

Some market observers also watch miner economics during periods of slower price action, as operational costs and revenue can influence sentiment. However, miner-related data can be interpreted in multiple ways and does not necessarily signal a definitive short-term direction.

With the chart lacking a clear trend, attention has also shifted toward projects positioning themselves around utility and product delivery. That said, outcomes for any individual token remain uncertain and carry risk.

Digitap’s Product Claims and Token Model (Project-Reported)

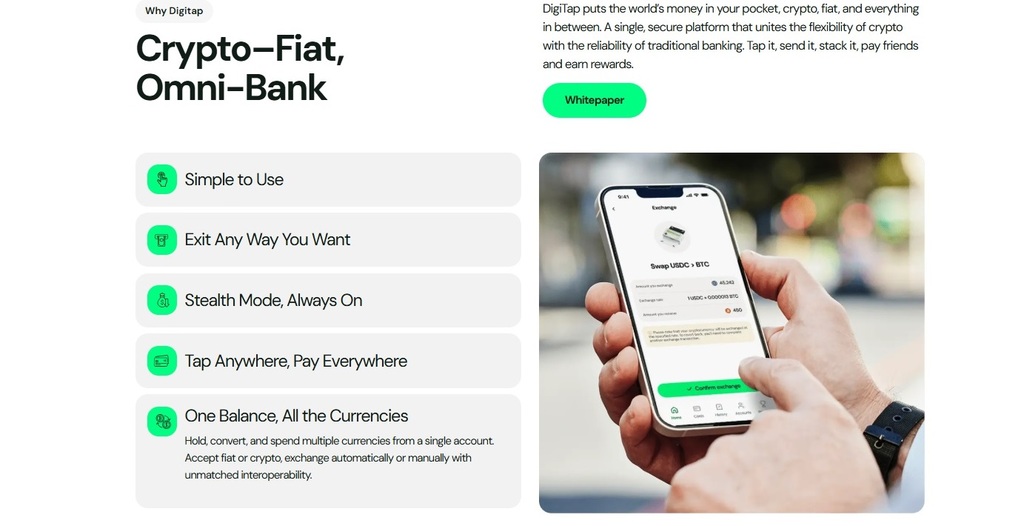

According to Digitap’s public materials, its “omni-banking” app is available on major app stores and is designed to let users manage fiat and crypto balances, including spending via virtual or physical Visa-branded cards where offered. Availability, features, and compliance requirements can vary by jurisdiction.

The project also states that a portion of platform profits may be used to purchase and burn $TAP tokens, which would reduce supply over time. These mechanisms depend on platform usage and financial performance and are not a guarantee of value or future price behavior.

Source: Digitap

Digitap also describes multiple verification tiers, including a wallet option that it characterizes as “no-KYC” and other tiers with higher limits that may require additional checks. Users should review applicable legal and compliance requirements in their region before using any financial app.

Overall, the project’s positioning centers on utility and on a revenue-linked token mechanism, but these claims are not independently verified here.

Market Context Often Cited by Banking-Focused Crypto Projects

Digitap and similar projects frequently point to limited access to traditional banking in parts of the world as a potential market. Such figures are commonly cited in fintech discussions, but the size of any addressable user base depends on regulation, distribution, and product-market fit.

Cross-border payments are also often highlighted as an area where digital financial tools may reduce friction and fees, though costs and settlement times vary widely by corridor and provider.

Source: Digitap

Freelancers and remote workers paid in crypto are another audience some platforms target, typically by offering tools to convert between crypto and fiat. The reliability of these services depends on liquidity, banking partners, and local rules.

Whether Digitap can translate these themes into sustained adoption remains uncertain and depends on execution and regulatory constraints.

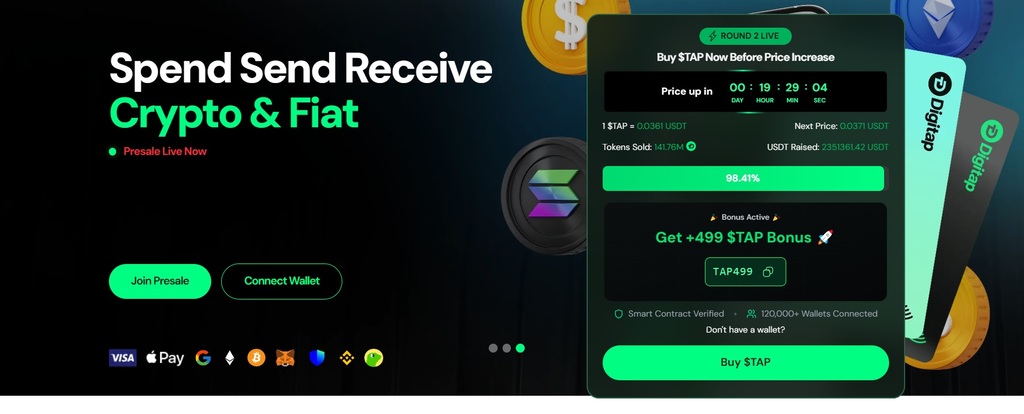

Digitap Token Sale: Reported Figures and Marketing Incentives

Digitap’s token sale materials include pricing tiers and progress figures. These numbers are provided by the project and have not been independently verified in this article. Token-sale terms can change, and participation carries risks, including loss of funds and liquidity constraints.

The project has also promoted time-limited marketing incentives, including a seasonal campaign it calls a “12-Day Christmas Sale,” which it describes as offering periodic rewards and account upgrades. Such promotions are marketing activities and should not be interpreted as indications of future token performance.

Key Takeaways to Watch Into 2026

Bitcoin remains near $90,000, with market participants weighing macro conditions, liquidity, and on-chain and miner-related signals. Separately, Digitap is positioning $TAP around a banking-app use case and a revenue-linked buy-and-burn mechanism, based on the project’s own descriptions.

For reference, readers can consult the project’s public materials directly:

Website (for reference): https://digitap.app

Social (for reference): https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.