TL;DR

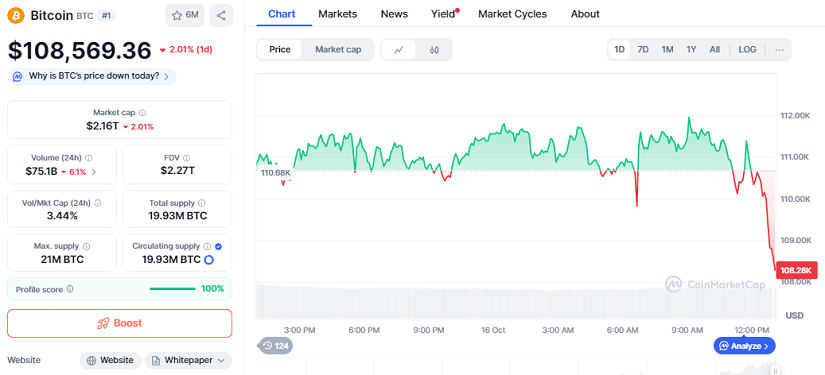

- Bitcoin is now trading near $108,569.36 after sliding 2.01% in the past 24 hours, bringing its market capitalization to roughly $2.16 trillion.

- Traders are watching closely as anticipation builds around Trump’s upcoming address, which could influence fiscal expectations and tariff policy.

- The latest downturn also coincides with increased short positioning from large players and a noticeable drop in trading volume to about $75 billion, down 6%.

Bitcoin has dipped below the $110,000 line again, hovering around $108,569.36 after a daily decline of 2.01%. The move extends a broader pullback that has erased more than 9% over the past week. Despite the drop, many long-term investors remain constructive, pointing out that capital continues to flow into infrastructure projects, custody solutions, and decentralized payment networks at a pace unmatched by other asset classes.

The broader macro backdrop has fueled uncertainty. Washington still has no agreement to avoid a government funding lapse, and several sectors are bracing for guidance from President Trump’s upcoming speech. Expectations are swirling that he may outline stances on budget priorities or tariffs on Chinese imports. Those details could either calm market nerves or trigger fresh volatility across global assets.

Whale activity is once again drawing attention. Data trackers have identified a large entity increasing short positions in a pattern similar to moves seen before earlier tariff news this month. Whether driven by advanced hedging or speculative positioning, the timing has raised eyebrows.

Market Sentiment And Technical Signals

Chart analysts note weakening momentum in recent sessions. The $110,000 mark, once viewed as a reliable support, is testing traders’ conviction as it now behaves like resistance. Indicators such as RSI show a slide toward neutral levels, and MACD readings point to a lack of immediate upward pressure. Some analysts mention that a firm daily close under $109,000 might open the door to a test near $105,000, though they caution that buyers have repeatedly emerged during previous pullbacks.

Still, the current 24-hour volume of $75 billion, despite being down 6%, reflects heavy repositioning rather than retreat. Large funds appear to be rotating capital rather than exiting positions outright. Institutional desks continue promoting Bitcoin as a portfolio hedge and long-term store of value in anticipation of looser monetary conditions over the next year.

Focus Turns To Policy Remarks

As Trump’s speech approaches, investors are bracing for commentary on fiscal spending and potential tariff expansions that could ripple through equities, commodities, and digital assets. Analysts believe clear signals on trade direction would influence short-term price action, but they also stress that accumulating interest from banks, insurers, and payment firms reinforces Bitcoin’s structural strength.