Bitcoin fell below $87K after a liquidation wave wiped out more than $600 million across the crypto market in a single day, based on widely cited derivatives-tracking estimates. Roughly $185 million of that was attributed to liquidations of leveraged long positions in Bitcoin. Some market observers described the move as among the sharpest one-day leverage flushes since October 2025 as margin calls and stop orders accelerated the decline.

Market participants are watching the $85K area as a near-term level. A sustained move below it could lead to additional liquidations, depending on where leveraged positions are concentrated.

Digitap ($TAP) continued its token-sale fundraising during the broader sell-off. The project said interest increased around the Black Friday period alongside time-limited promotional offers and a jump in participation.

The project has also pointed to continued inbound demand after the campaign, as some traders look beyond major assets for smaller-cap tokens with product narratives. These claims have not been independently verified.

Why Are Crypto and Bitcoin Crashing? Macro and Leverage Finally Aligned

Bitcoin’s decline accelerated after Japanese two-year bond yields moved above 1 percent for the first time since 2008. Markets interpreted the move as a signal that the Bank of Japan may shift away from ultra-loose policy after more than a decade of cheap liquidity. That shift sent risk assets into repricing mode, with volatility rising across global markets. BTC, as a high-volatility asset, often reacts quickly during broad risk-off moves.

The next phase of the drop was driven by leverage. The macro-triggered breakdown pushed Bitcoin below short-term support levels and activated a wave of stop-loss orders that cascaded into liquidations. With exchanges force-selling leveraged long positions into thinner liquidity, prices fell quickly over a short period.

Source: X/@KobeissiLetter

Bitcoin’s behaviour highlights its sensitivity to global liquidity conditions rather than acting as an isolated hedge. Rising yields and the possibility of tighter financial conditions can reduce demand for higher-volatility assets. This connection can turn BTC into a macro-driven instrument that reacts sharply to expectations around monetary policy. As long as yields rise and safer assets improve in attractiveness, Bitcoin may face headwinds.

The market continues to monitor the $85K zone as a key area for the short-term trend. Traders remain defensive as uncertainty persists around global bond markets.

Digitap: An Omni-Bank Concept Positioned Around Market Uncertainty

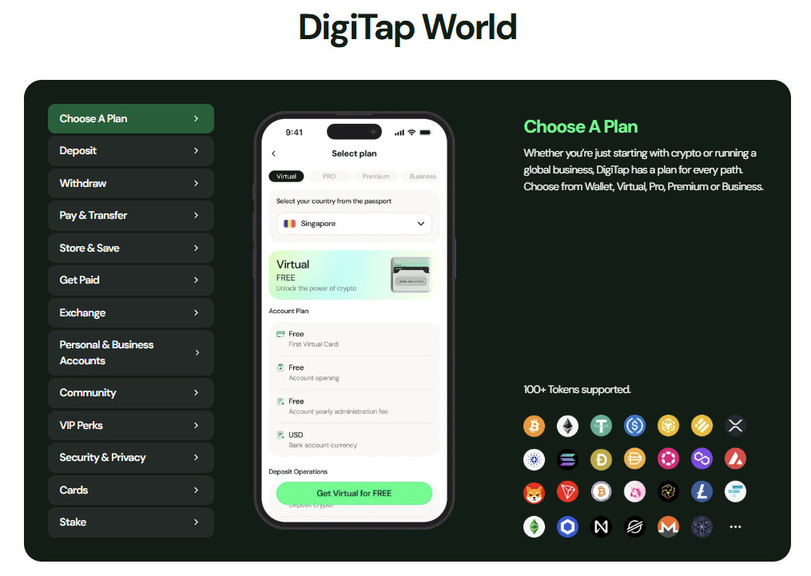

According to project materials, Digitap operates as an “omni-bank” application intended to combine fiat and crypto tools in one interface. The project describes features such as transfers, swaps, payments, and account management through a dashboard available on iOS and Android. It also states that users keep control of assets through a self-custody design.

Digitap also references a Visa-branded card as part of its offering. Availability, verification requirements, and supported jurisdictions can vary for card products and should be confirmed directly with the provider.

The project positions its functionality for users dealing with cross-border payments and multi-currency management. As with any crypto-related service, users should consider operational, regulatory, and custody risks.

Digitap’s token sale is being marketed with staged pricing, including figures such as $0.0334 and $0.0361, and the project has stated that more than 135 million tokens have been sold and that over $2.2 million has been raised. The project has also referenced a $0.14 intended listing price, but listings and future pricing are not guaranteed.

What to Know About $TAP in the Current Market

Bitcoin’s volatility reflects a market navigating rising yields, reduced liquidity, and leveraged-position unwinds. Digitap’s activity during this period has been described by the project as driven by product positioning and marketing campaigns rather than broader price action.

Any token-sale pricing changes should be treated as project-defined fundraising terms rather than indicators of future market performance.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.