TL;DR

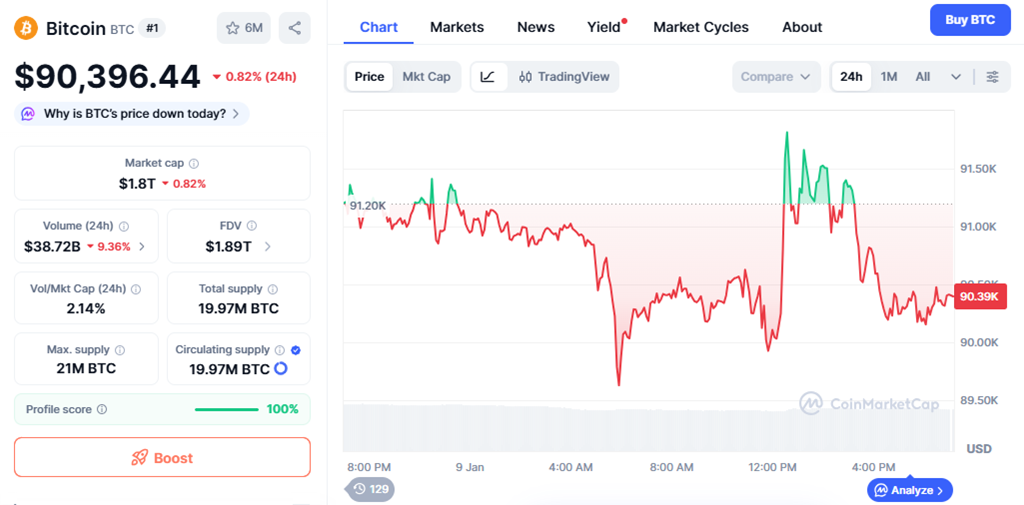

- Bitcoin trades around $90,396 after several weeks of sideways movement similar to last year’s consolidation before the surge above $126,000.

- The current range between $80,000 and $95,000 has lasted close to 50 days, matching the duration of the 2025 setup.

- On-chain metrics indicate rising market compression, while macroeconomic and liquidity conditions continue to support risk assets despite a 0.82% decline over the past 24 hours.

Bitcoin shows signs of a rally that mirrors last year’s push toward $126,000 as price action enters a prolonged consolidation phase. BTC currently trades near $90,396, down 0.82% in the last 24 hours, yet remains firmly within a range that has dominated market behavior for several weeks. Analysts increasingly compare this structure to early 2025, when similar conditions preceded a strong upward move.

The cryptocurrency has fluctuated between $80,000 and $95,000 since late November, forming a roughly 20% corridor. This mirrors the earlier range between $76,000 and $85,000 that persisted for just over 50 days before momentum returned. While volatility remains muted, the extended duration itself has become a key focus for traders.

Time-Based Capitulation And Bitcoin Market Structure

Market participants describe these long periods of limited price movement as time-based capitulation. Instead of sharp drawdowns, Bitcoin pauses long enough to push short-term holders out. In recent cycles, Bitcoin has favored this approach, reflecting its evolution into a more mature asset with deeper liquidity and broader participation.

The consolidation last year ended with a steady advance that carried BTC above $126,000 by October. The current range now approaches a similar time span, reinforcing comparisons between the two periods. On-chain data supports this outlook, with Checkonchain’s choppiness metric recently rising to around 53, a level historically associated with directionless trading that often precedes sharp breakouts.

Macro Conditions Support Risk Appetite

Broader economic factors also influence sentiment. Traditional markets indicate resilience, with the Atlanta Fed’s GDPNow tracking real GDP growth at 5.4% for the fourth quarter. This backdrop supports continued risk-taking even as monetary policy remains cautious.

Interest rate expectations remain significant. While the Federal Reserve appears patient in the short term, markets still anticipate 50 basis points of rate cuts in 2026. Political signals add to liquidity expectations. Former Pimco CEO Mohamed El-Erian notes that large-scale purchases of mortgage-backed securities could maintain market support if affordability concerns persist.

Together, these factors frame conditions similar to those that preceded last year’s breakout. While BTC remains range-bound today, the combination of time-based consolidation, structural setup, and macro support suggests the market could be preparing for the next directional move.