TL;DR

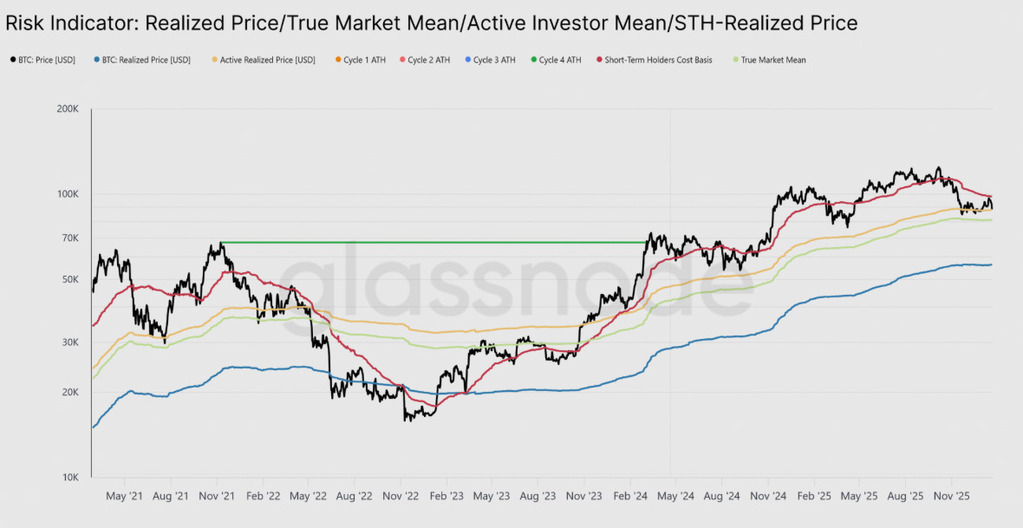

- Bitcoin is trading within a range between the True Market Mean at $81,100 and the short-term holder cost basis at $98,400.

- The entity-adjusted URPD shows a dense UTXO zone above $100,000, formed during 2025.

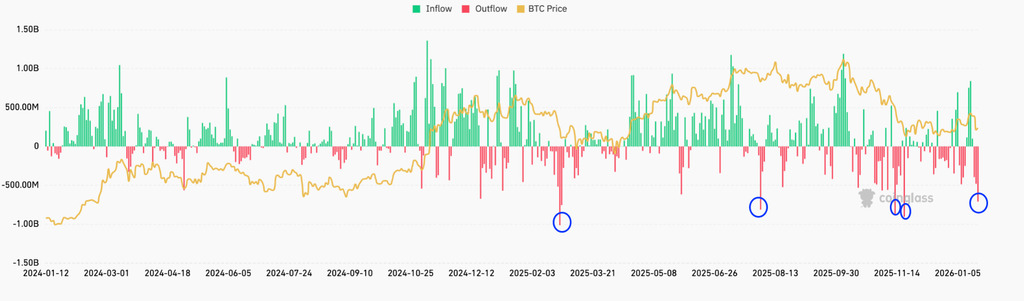

- Derivatives and options show low participation, volatility reacting only at the short end, and asymmetric gamma. Spot Bitcoin ETFs have accumulated outflows of $1.58B.

Bitcoin remains confined to an operational range defined by the True Market Mean at $81,100 and the short-term holder cost basis at $98,400. During January 2026, price moved up from the middle of the range and stalled below $98,000, where supply from recent buyers operating near breakeven levels is concentrated.

On-chain data shows a structure dominated by accumulated supply above the current price. The entity-adjusted URPD identifies a broad and dense zone of UTXOs created above $100,000. This band concentrates coins acquired between the first and third quarters of 2025 and acts as an active source of sell-side liquidity as price approaches those levels.

Holders Releasing Bitcoin Supply

The age distribution confirms the pattern. The largest share of realized losses comes from the 3 to 6 month holder cohort, followed by the 6 to 12 month segment. Both groups acquired Bitcoin at levels above current prices and release supply when price returns to their entry zones. At the same time, profit-taking is concentrated in the 0% to 20% margin range, increasing sell pressure near cost-basis levels.

In the spot market, both aggregate CVD and Binance CVD have shifted toward net buying. Coinbase has steadily reduced the seller aggressiveness observed in previous weeks. Even so, activity remains focused on selective absorption of supply, with no evidence of broad and sustained accumulation.

Corporate flows remain uneven. Inflows are linked to isolated transactions and do not establish a continuous buying pattern. On an aggregate basis, flows continue to oscillate near neutral levels.

Derivatives and Options Markets

In derivatives markets, futures volume remains compressed on seven-day moving averages. Changes in open interest are occurring without volume expansion, indicating position rotation rather than the addition of new leverage. The market continues to operate with low participation.

In options markets, implied volatility reacts only at short maturities. One-week volatility rises by more than 13 points, while three- and six-month tenors show marginal changes. Short-term skew shifts toward puts and then reverses. The one-month volatility risk premium remains positive, around 11.5 points.

Bitcoin ETFs Under Pressure

Dealer gamma positioning turns negative below $90,000 and positive above that level, introducing asymmetry in hedging dynamics.

At the same time, spot Bitcoin ETFs recorded net outflows of $708.7M yesterday. Over three days, cumulative outflows reached $1.58B. BlackRock’s IBIT and Fidelity’s FBTC account for most of the negative flows. Meanwhile, spot Ethereum ETFs posted total outflows of $286.9M