TL;DR

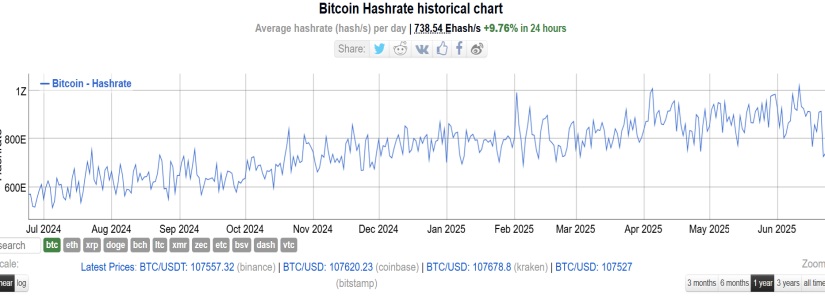

- Bitcoin’s hashrate dropped to 684.48 EH/s, its lowest level since October 2024, driven by rising costs and energy restrictions in key mining regions.

- The network will lower its difficulty by 9.4% on June 29, which could ease miner margins and bring back some of the disconnected capacity.

- Despite the decline in mining power, Bitcoin holds steady at $106,000, supported by institutional inflows through ETFs and a weaker correlation with stock markets.

Bitcoin’s hashrate fell this week to its lowest point since October 2024, in a context of rising mining costs and energy limitations in several regions.

The network recorded a daily average hashrate of 684.48 EH/s, far from the 966 EH/s peak on June 20. Although the current figure still stands well above the 379.55 EH/s registered in July 2023, miners now face operational challenges in an increasingly competitive market.

The main factor behind this drop is a surge of over 34% in mining costs during Q2 2025. Rising electricity prices, equipment maintenance, and hardware replacement expenses have raised profitability thresholds for much of the network. On top of that, energy-saving programs in countries with a high concentration of mining farms have led some facilities to shut down equipment to ease grid demand.

Bitcoin Holds Steady Despite the Hashrate Drop

While some operators pointed to geopolitical tensions as an additional factor, active miners agree that weather conditions in the United States have had a more decisive impact on reducing available computing power. Even in this environment, Bitcoin’s price remains stable at $106,000, sustained by ongoing institutional demand through ETFs. BlackRock continues absorbing supply while traditional stock markets show weakness.

The upcoming difficulty adjustment, scheduled for June 29, could alter this situation. The network will lower its difficulty from 126.41 T to 114.40 T, a cut of around 9.4%. This adjustment will temporarily ease pressure on active miners, improve margins, and might incentivize the return of disconnected rigs. However, if hashrate levels fail to recover swiftly, the network could face increased exposure to potential attacks, although current levels remain sufficient to prevent serious security risks.

In the long run, this drop could prove beneficial by filtering out less efficient operators. The stable price behavior and steady growth of financial products tied to Bitcoin suggest that, despite operational difficulties, the market still bets on its resilience