TL;DR

- The beginning of October brought a surprising drop for Bitcoin (BTC), which lost 3.05%, trading at $61,671, while geopolitical tensions in the Middle East increase.

- This situation generated massive liquidations in the futures sector, exceeding $250 million, contributing to the downward pressure in the crypto market.

- Other cryptocurrencies also suffered significant losses, with Ethereum falling 5.3% and Dogecoin losing 9.8%, reflecting a general trend of selling in risk assets.

The start of October has marked an unexpected turn for the crypto market, as Bitcoin (BTC) experienced a drastic price drop.

The decline occurred in the context of rising geopolitical tensions, especially following recent statements from the White House warning of possible attacks by Iran on Israel. This situation has triggered a domino effect in the markets, causing a strong sell-off in U.S. stocks and an increase in oil prices.

Abrupt Collapse for Bitcoin

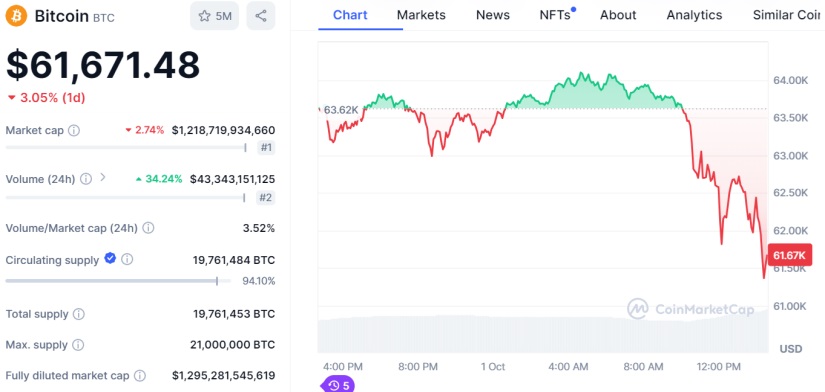

Faced with this chaotic scenario, Bitcoin (BTC) has seen its price drop to $61,671. This represents a decrease of 3.05% in the last 24 hours. Bitcoin’s market capitalization has followed the same path, as shown by CoinMarketCap data. At the same time, trading volume has skyrocketed by 34.24%.

It is worth noting that BTC had been consolidating a recovery period, having temporarily surpassed $66,000, starting from a low of $52,800 reached on September 6. Statistically, it still reflects a monthly increase of 6.5%, but the abrupt drop has left the weekly statistics showing losses exceeding 2.8%.

The environment of uncertainty has not only affected Bitcoin but has also led to massive liquidations in the futures sector. In the last day, over $250 million in futures positions were liquidated in the crypto market, with $200 million corresponding to long positions betting on an increase in the value of BTC. Traders who anticipated a price rebound have lost their positions, contributing to the downward pressure in the market.

The Bearish Wave Hits the Entire Crypto Market

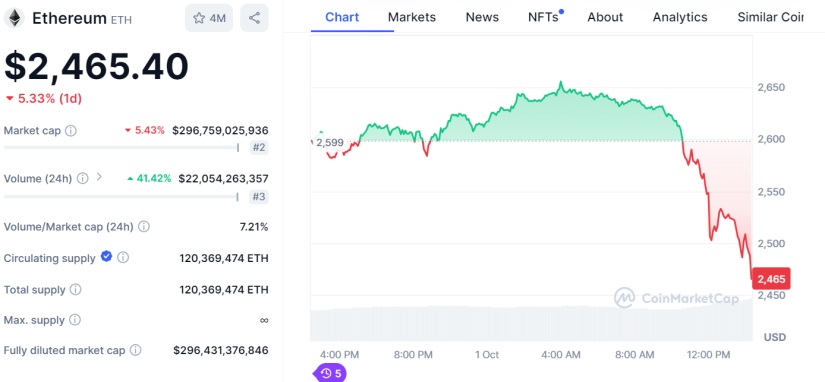

Ethereum (ETH), the second-largest cryptocurrency, also suffered a significant drop, trading at $2,465 after a reduction of 5.3% during the same period. Meanwhile, Solana (SOL), the fifth-largest cryptocurrency, recorded a decrease of 5.13%, reaching a price of $146.85.

On the other hand, other cryptocurrencies are facing even more pessimistic figures. Dogecoin (DOGE) is sinking, losing 9.8% of its value, dropping to a price of $0.1058. It is followed by Toncoin (TON), which is trading at $5.25 after falling 8.22%, and Avalanche (AVAX), which plummeted 8.35% and is being traded at $25.76. A general trend is consolidating in the cryptocurrency market, where the sale of risk assets seems to be dominating operations.

Despite October traditionally being considered a favorable month for the crypto market, this start contrasts with the profit expectations that characterize this period known as “Uptober.” The total value of the cryptocurrency market is currently estimated at $2.14 trillion, representing a drop of 4.7% in the last 24 hours. With a global trading volume reaching $97 billion, of which $43.72 billion corresponds to Bitcoin transactions